- Home

- Intermediates, Fine and Specialty Chemicals (Products)

CPHI Online is the largest global marketplace in the pharma ingredients industry

-

Products0

-

Companies0

-

Articles0

-

Events0

-

Webinars0

Intermediates, Fine and Specialty Chemicals (Products)

Intermediates, Fine and Specialty Chemicals (Products) Companies (500+)

Intermediates, Fine and Specialty Chemicals (Products) News

-

News Evotec enters drug discovery collaboration with Janssen Pharmaceutica NV

Evotec and Janssen Pharmaceutica team up to discover novel therapeutic candidates14 Jun 2022 -

News Seqens commits to US market with multi-million dollar investment in R&D

A redeveloped R&D facility will enhance Seqens' capabilities in developing and producing APIs and active delivery systems development23 Mar 2022 -

News Steps for Building Supply Chain Integrity and Resilience in Europe

Speakers from the European Fine Chemicals Group, the voice of fine chemical manufacturers in Europe, led a discussion on the ‘globalised, fragmented and complex’ API and raw materials supply chain, in this month’s edition of the CPHI ...2 Feb 2022 -

News Flamma USA opens doors to HPAPI suite

The CDMO says the suite will help to "bring back manufacturing to the US"5 Nov 2021 -

News API supply chain needs to address future challenges arising from China situation: CPHI Worldwide panel

COVID-19 pandemic has exposed weaknesses and sector faces new challenges driven by rising costs of production in China26 Oct 2021 -

News Next stop, Milan - Welcome to Italy's life sciences hub

Milan is home to an internationally competitive pharmaceutical, biotechnology and functional foods hub, with strong growth prospects and a commitment to innovation across its entire supply chain. Italy is also home to one of the most advanced and ...21 Oct 2021 -

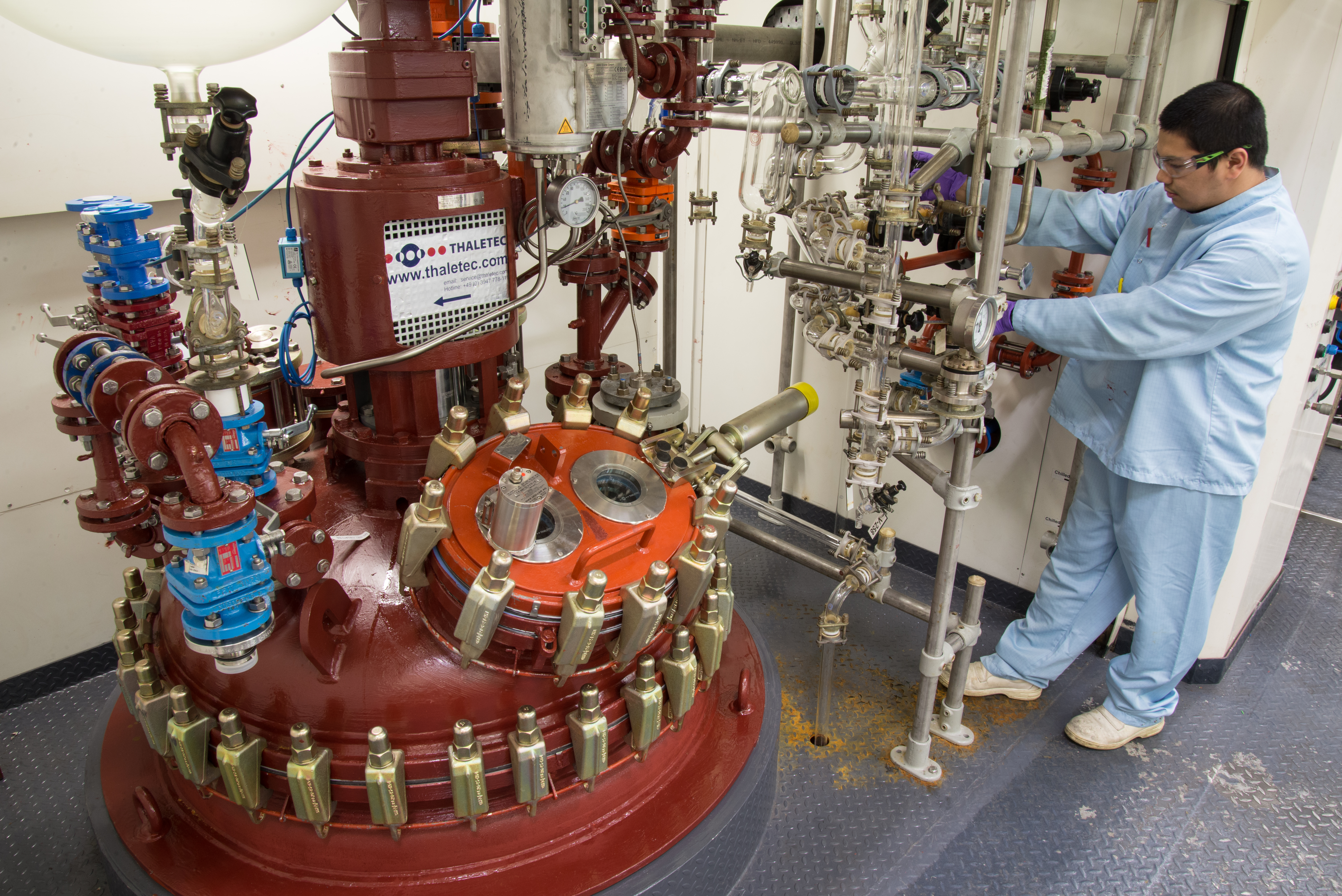

News AGC Pharma Chemicals Europe invites you to a live guided virtual tour

Step inside our state-of-the-art plant to learn about our small molecules CDMO services and meet our team with a virtual tour that focuses on your areas of interest.6 May 2021 -

News CPHI Online Report - Pharma Market Trends 2021

Twelve pharma market trends we anticipate across 2021 for the drug development, manufacturing and outsourcing sectors.25 Nov 2020 -

News Empathy is the key to successful leadership: Women in Leadership Forum

Female life sciences leaders share their experiences and discuss the skills and attributes needed these days to become a successful leader and empower teams22 Oct 2020 -

News CPHI Festival of Pharma Blog

With the Festival of Pharma now well and truly upon us, keep abreast of all that is happening and when over the ten days of this vast virtual event.15 Oct 2020 -

News CPHI Festival of Pharma Podcast - Day One

The CPHI Festival of Pharma has finally opened up! Tune into this podcast in which Informa Markets Head of Pharma Content, Tara Dougal, and Pharma Editor, Gareth Carpenter outline the rich content that is available to registrants on the first day of th...4 Oct 2020 -

News *Ultra Pure Sodium Hyaluronate* by Contipro

Please find company brochure attached that includes the ultra pure specification22 Sep 2020 -

News CPHI South East Asia rescheduled to May 2021

Details of new CPHI South East Asia Online Business Matchmaking Platform to be announced shortly.12 Aug 2020 -

News CPHI Japan rescheduled for Spring 2021

The event organizers are working on preparing bespoke digital product offerings to help the market continue to meet, do business and exchange ideas later this year.27 Jul 2020 -

News CPHI Worldwide to transform into Festival of Pharma digital experience

The 10-day event will feature an interactive digital marketplace for sourcing products and services, enhanced matchmaking for connecting with new and existing partners, and world-renowned speakers.30 Jun 2020 -

News CPHI & P-MEC China moves to December to enable international attendance

Date alteration taken at the request of exhibitors to ensure the international character of China’s largest pharma exhibition.21 Apr 2020 -

News CPHI announces new pharma events calendar for 2020

Organizers secure three new dates for events in Japan, South East Asia and North America in response to COVID-19.17 Mar 2020 -

News Indian pharma supply chain disruption could surpass 2017 if COVID-19 not contained within three months: Ind-Ra

Indian pharmaceutical supply chain disruption could be far greater than the China environmental regulation-induced shortfall of 2017 If the COVID-19 outbreak is not contained within the next three months, credit ratings agency India Ratings and Researc...13 Mar 2020 -

News CPHI Japan 2020 Postponed

Rescheduling will ensure all stakeholders can take part in a successful exhibition and conference.27 Feb 2020 -

News CPHI South East Asia rescheduled for July 2020

Event move ensures extra precautions and safety measures taken18 Feb 2020

Intermediates, Fine and Specialty Chemicals (Products) Products (2500+)

-

Product N,N-Dimethyl Aniline

Anhui royal chemical co., ltd provides wide range of pharmaceutical products which includes n,n-dimethyl aniline.N,N-Dimethyl Aniline is a versatile intermediate used in the pharmaceutical industry for the synthesis of active pharmaceutical ingredients (APIs). It plays a crucial role in the manufacture of ...

-

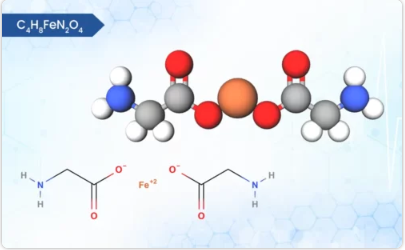

Product FERROUS BISGLYCINATE

Ferrous bisglycinate, a well-tolerated iron supplement, boasts unique physical and chemical properties. It is light to dark greenish powder with occasional friable lumps and virtually no odor. Interestingly, this powder is non-hygroscopic, meaning it won’t readily absorb moisture from the air, enhancing it...

-

Product NH3 MeOH /NH3 EtOH / NH3 IPA / NH3 THF / MMA MeOH / MMA EtOH / MMA H2O / DMA THF

Ammonia, Monomethylamine, Dimethylamine (gas) dissolved in organic solvents at tailor-made concentrations ready to be used in your API and Fine Chemicals synthesis process.

These mixtures will bring less risks (i.e no hazardous gas handling), more productivity (i.e free up space in the reactors)...

-

Product DEPOLLUTION WITH NANOSCAVENGERS

We are looking for a strategic environmental partner in order to develop pilot programs on heavy metals, PFAS... specific at your company with the use of magnetic nanoparticles (NP's). Our technological platform allows us to create Nano-Scavangers capable of searching for pollutants in liquids (wastewater,...

-

Product Gobi Gold Daily Balancer(R)

Incorporating PRT(R) Beads and Fusion Technology(R) in Gobi Gold Daily Balancer(R)enabled us to combine the essential fat-soluble and water-soluble nutrientsin ONE capsule simplifying dosing schedule without exceeding therecommended daily dose. We succeeded to combine materials with different properties an...

-

Product Triphenylphosphine (TPP) [CAS# 603-35-0]

Hokko chemical industry offers a wide range of phosphines products which includes triphenylphosphine. It belongs to organophosphines category. Contact us for more information.

-

Product Ginkgo Biloba Extract

Changsha Huir Biological-Tech Co., Ltd. is a Pre-listed professional herbal extracts and APIs manufacturer with Five Plants in China, Three Warehouses in USA(CA,NY,FL), One warehouse in Europe Changsha Huir Biological-Tech Co., Ltd. Hunan Huirui Pharmaceuticals Co; Ltd Address: Fl 20, Jin...

-

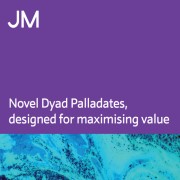

Product Ticagrelor

CTX Manufacturer Form - II

O DMF available.

CEP Approved.

CTX Lifesciences respects patent laws and conventions of pharmaceuticals as applicable in different countries.

API/Substances covered by patent are not offered to the countrie...

-

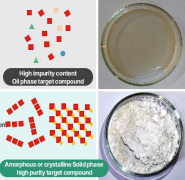

Product TBFA

High purity target compounds in solid phase (amorphous/crystalline form) rather than oil phase.

Detailed technologies: 1) High-purity synthesis technology

2) Separation and purification technology

3...

-

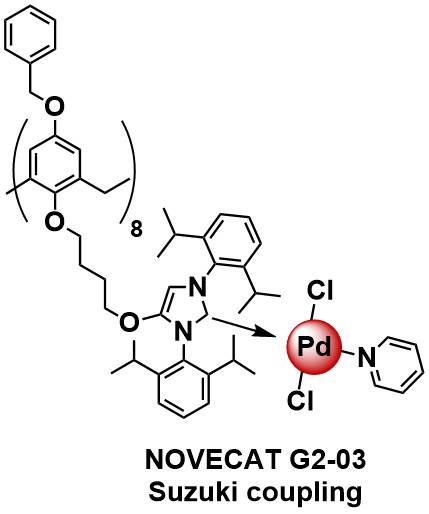

Product API Services, Chemical Development & Manufacture

Almac’s strength in API development and manufacture is proven by being the partner of choice for many pharma and biotech companies seeking integrated drug development solutions from molecule to market.

Our technical expertise and extensive facilities enable us to offer integrated API contract ma...

-

Product Bromine and Derivatives

Our Bromine and Derivative products are used in chemical synthesis, oil and gas well drilling and completion fluids, mercury control, paper manufacturing, water purification, beef and poultry processing and various other industrial applications. Other performance chemicals that we produce include tertiary ...

-

Product Sodium Acetate

Alchacet by Alchimica offers high-quality acetates tailored for diverse industrial applications.By prioritizing excellence, quality and reliability, Alchacet ensures that every batch meets thehighest standards of performance. Trust in Alchacet to deliver cutting-edge solutions thatenhance your industrial p...

-

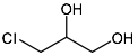

Product 3-Chloro-1,2-propanediol (R)-(-)-Epichlorohydrin (S)-(+)-Epichlorohydrin (R)-(+)-Propylene carbonate

(R)-(+)-Propylene carbonate 16606-55-6 (R)-(-)-Epichlorohydrin 51594-55-9; (S)-(+)-Epichlorohydrin 67843-74-7; 3-Chloro-1,2-propanediol 96-24-2; (R)-(-)-3-Chloro-1,2-propanediol 57090-45-6; (R)-(-)-Glycidyl butyrate 60456-26-0; (S)-(-)-4-Chloromethyl-2,2-dimethyl-1,3-dioxolane 60456-22-6; (S...

-

Product (R)-4-methyl-1,3,2-dioxathiolane 2,2-dioxide 1006381-03-8

- Appearance: Colorless to light yellow solid- Molecular formula: C3H6O4S- Molecular weight: 138.14- Melting point: 81-83°C- Boiling point: 221.8±7.0 °C (Predicted)- Solubility: Soluble in water and organic solvents such as alcohol and ether

-

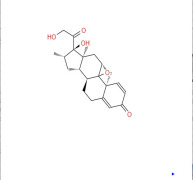

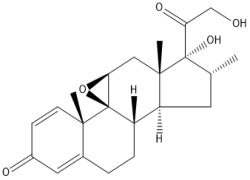

Product 16β-Methyl Epoxide (DB11)

9β,11β-Epoxy-17,21-dihydroxy-16β-methylpregna-1,4-diene-3,20-dione. This compound is a key intermediate in the dexamethasone and betamethasone series of drugs.

-

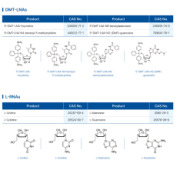

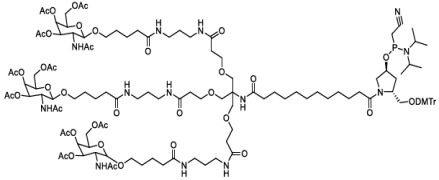

Product Nucleosides

• DMT-DNAs • DMT-2’ - OMe-RNAs

• DMT-2’ - MOE-RNAs

• DMT-2’-F-RNAs

• PMOs

• DMT-2’-OTBDMS-RNAs

• L-RNAs

• DMT-LNAs

• DMT-2’-OTOM-RNAs• Other Derivatives

-

Product Atorvastatin Ca

Status: Commercial; Specification: EP,USP,CP;Submission of Regulations: EDMF, CEP, USDMF under preparing, CDMF.

-

Product 5-Bromoindole-2-carboxylic acid

We are a manufacturer from China, producing all kinds of pharmaceutical intermediates and apis. 5-Bromoindole-2-carboxylic acid is one of our popular products in the world.

Our company also produces and supplies its similar products, such as:

5-Bromo-2-fluoro-m-xylene CAS 99725-44-7&...

-

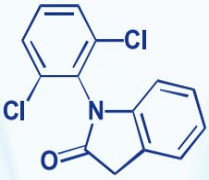

Product Indolinone

CAS NO.:15362-40-0Chemical Name: 1-(2,6-dichlorophenyl)-2-indolinone

Molecular Formula: C14H9Cl2NO

Molecular Weight: 278.13

Usage:Intermediate of Diclofenac Sodium

-

Product Pharma Intermediates

As per customer requirements.

Visit website for detailed product list : https://aparnapharma.com/intermediate/

-

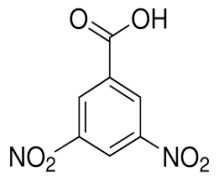

Product 3,5-Dinitro Benzoic Acid

Color : Light Yellow

Form : Crystals

Melting Point : Not less than 206°C

Color of Solution : Less than GY5

Absorbance [410 nm] : Less than 0.95

Loss on Drying (%) : Not more than 0.2

Assay : Not less than 99%

-

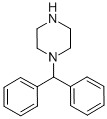

Product 1-(diphenylmethyl)-piperazin

Organic synthesis and pharmaceutical synthesis intermediates, which can be used to synthesize antihistamine drugs, such as the H1-receptor antagonist Oxatomide.

Downstream products: Cinnarizine-->Oxamide-->Meclizine-->2-(4-Diphenylmethylpiperazin-1-yl)ethyl 3-oxylidene butyl ester-->...

-

Product Uni-Carbomer 20 / Acrylates/C10-30 Alkyl Acrylate Crosspolymer

Discover new possibilities in rheology control with Uni-Carbomer 20 polymer. Improve processing without sacrificing performance, and take your formulations to a higher level. For high clarity, low tack and smooth flow in gels, the choice is Uni-Carbomer 20 polymer. For efficient thickening in the presence ...

-

Product Ferrous Gluconate

Shandong Xinhong Pharmaceutical Co Ltd offers a wide range of products which includes ferrous gluconate. Characteristics: light yellow gray or yellow granule or powder with slight gray green. Uses: iron is one of the major composition, which constitutes, hemoglobin, myoglobin, cellular chromatin and some t...

-

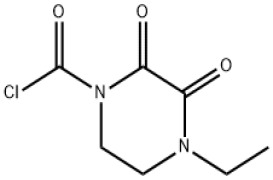

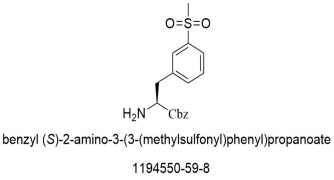

Product Lifitegrast Intermediates,CAS#1194550-59-8

We supply all 3 key intermediates of Lifitegrast at significantly lower cost. We are also the FIRST AND LARGEST supplier in China for commercial scale.

-

Product (2R,3R)-3-(2,5-Difluorophenyl)-3-hydroxy-2-Methyl-4-(1H-1,2,4-triazol-1-yl)thiobutyraMide

Isavuconazole intermediate

-

Product Hydroxypropyl Beta Cyclodextrin

2-Hydroxypropyl beta cyclodextrin: white powder,sweet; increase the solubility of the medicine and biological availability.

CAS No. 94035-02-6(128446-35-5)

-

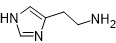

Product Imidazole

CAS No.:[288-32-4]

Molecular formula:C3H4N2

Formula weight:68.08

EINECS No.:206-019-2

Appearance: White crystal

Packing: Inner double PE bag; outer cardboard drum, steel drum or plastic woven bag. Class III package.

Storage conditions: In a cool, ventilated, and dry room, ...

-

Product 4-Hydroxyphenylacetic Acid

Shandong Yangcheng Biotech Co. Ltd offers wide range of pharmaceutical products which includes 4-Hydroxyphenylacetic Acid.

it is a monocarboxylic acid that is acetic acid in which one of the methyl hydrogens is substituted by a 4-hydroxyphenyl group.

Usage: an important pharmaceutical inter...

-

Product Zinc Powder (Zinc Dust)

Zinc powder (dust) has a strong reducibility and hydrogen is released with acid and alkali.

It mostly used as anti-corrosive paint in industrial coating. These metallic zinc pigments act as active preservatives and form a coating on the metal surface to protect the structure of the building. It also a...

-

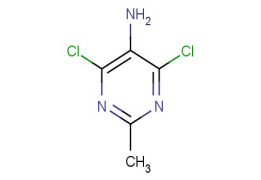

Product 5-Amino-4,6-dichloro-2-methylpyrimidine

CAS :39906-04-2

CAT# :6960

NAME :5-Amino-4,6-dichloro-2-methylpyrimidine

MDL :MFCD00194053

EINECS :419-110-9

MOLWEIGHT :178.02

MOLFORMULA :C5H5Cl2N3

-

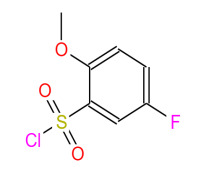

Product 5-Fluoro-2-methoxybenzenesulfonyl chloride

Name: 5-Fluoro-2-methoxybenzenesulfonyl chlorideCas No: 67475-56-3

MF: C7H6ClFO3S

-

Product Fmoc-Amino Acids

Water(K.F)≤1.0 %Any other impurity≤0.1 %Purity (HPLC)≥99.0%(Area%)

Assay(AT)≥98.5%(AT)

-

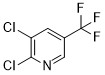

Product 2,3-Dichloro-5-(trifluoromethyl)pyridine

Dalian join king fine chemical co. Ltd offers a wide range of products which includes 2,3-Dichloro-5-(trifluoromethyl)pyridine. Contact us for more information.

-

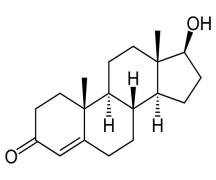

Product Testosterone

Testosterone is the male sex hormone that is made in the testicles. It is used as an alternative treatment of anteschia, also used in treating male climacteric syndrome and erectile dysfunction.Testosterone has CP, EP and USP specification, DMF and CEP is in-process.

-

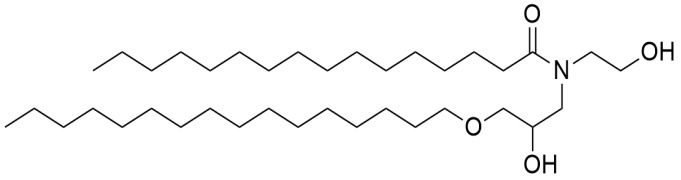

Product Cetyl-PG hydroxyethyl palmitamide(CAS:110483-07-3)

Cosmetic raw materials

Cetyl-PG hydroxyethyl palmitamide

CAS:110483-07-3

-

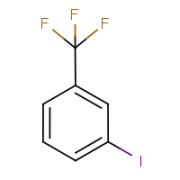

Product 3-Iodobenzotrifluoride

Infinium Pharmachem Manufacturing various Organic and Inorganic Iodine derivatives.

Cas No :- 401-81-0

Molecular Formula :- C7H4F3I

Synonyms :-1-IODO-3-(TRIFLUOROMETHYL)BENZENE 3-IODO-1-TRIFLUOROMETHYLBENZENE 3-IODO-ALPHA,ALPHA,ALPHA-TRIFLUOROTOLUENE 3-IODOBENZOTRIFLU...

-

Product 1-[(tert-butoxy)carbonyl]azetidine-3-carboxylic acid

1-[(tert-butoxy)carbonyl]azetidine-3-carboxylic acid

-

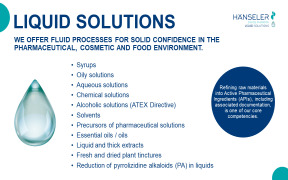

Product Liquid Solutions

Chemical solutions (GMP-compliant): • API & excipients • Hazardous materials • Explosives • Filling under inert gas

Special extracts and tinctures: • Mother tinctures • Boswellia extract • Opium tincture • Capsicum extract • Henbane extract • Cannabis extract

Packaging • 2...

-

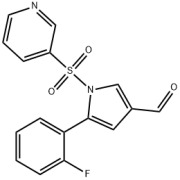

Product 5-(2-fluorophenyl)-1-(pyridin-3-ylsulfonyl)-1H-pyrrole-3-carbaldehyde

5-(2-fluorophenyl)-1-(pyridin-3-ylsulfonyl)-1H-pyrrole-3-carbaldehydeCasNo:881677-11-8 Molecular Formula:C16H11FN2O3SPurity:99.8%+Molecular Weight:330.33

-

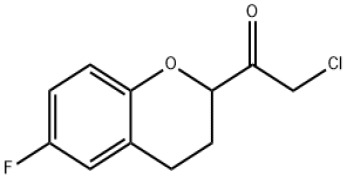

Product 2-chloro-1-(6-fluoro-3,4-dihydro-2H-chromen-2-yl)-ethanone

Aba Chemicals Corporation has all the technology and capability to manufacture at commercial scale the product 2-chloro-1-(6-fluoro-3,4-dihydro-2H-chromen-2-yl)-ethanone (also known as Chloroketone used fas KSM or the manufacturing of API named Nebivolol), also we have the knowledge for the downstream epox...

-

Product (2S)-2-(8-amino-1-bromoimidazo[1,5-a]pyrazin-3-yl)-1-Pyrrolidinecarboxylic acid phenylmethyl ester

CAS NO.: 1420478-88-1Purity: 99%

Documents and Audit can be supported

-

Product Contract R&D and Scale-Up

Actylis offers GMP, biopharma and non-GMP specialty chemical custom ingredient research and development services by generating robust, practical and cost-effective processes for the preparation of specialty chemicals, excipients, and pharmaceutical ingredients. With decades of experienc...

-

Product Carbohydrazide

Carbohydrazide

Molecular formula CH6N4O

Molecular weight 90.08

CAS NO. 497-18-7

Usage Carbohydrazide has strong reducibility. It can be used as energetic material intermediate, components of fire explosive and propellant directly; also...

-

Product Trusted Ingredients for Pharmaceuticals

With Spectrum Chemical, meet the requirements specified in the USP and NF monographs, which are the official standards for all prescription and over-the-counter medicines, dietary supplements, excipients and other healthcare products.

- Ideal for parenteral, oral, topical and ophthal...

-

Product SIMULATED MOVING BED CHROMATOGRAPHY (SMB)

KD Pharma is a contract manufacturer that develops products in the pharmaceutical space by employing state-of-the-art technology. Since its inception in 1988, KD Pharma has focused on utilizing cutting edge technologies to develop and manufacture exceptional quality APIs. These twin pillars of technology a...

-

Product 6-(4-Aminophenyl)-4,5-dihydro-5-methyl-3(2H)-pyridazinone

Application: Levosimendan intermediate, the purity is 99.9%, maximum single impurity is 0.07%, off-white solid.

-

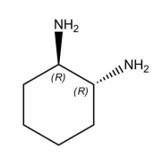

Product (R,R)-(-)-1,2-Diaminocyclohexane (and diastereomers)

Arran offers a wide range of chiral products which includes (R,R)-(-)-1,2-Diaminocyclohexane (and diastereomers). Contact us for more information.

-

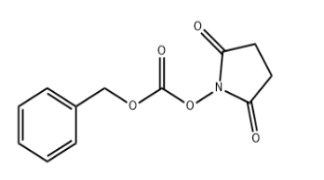

Product N-(Benzyloxycarbonyloxy)succinimide

Appearance:white crystalline powder Assay(by HPLC):≥98%

Usage:it can be used in the synthesis of CBZ protects amino acids.

-

Product WeylChem InnoTec > Innovative Fine chemical, Pharmaceutical and Electronic Industry Partner

WeylChem InnoTec are your innovative partner to the fine chemical, pharmaceutical and electronic industry. We provide world-class analytical, modern developmental and tailor-made manufacturing services. With our competencies in Analytics, Contract Development & Custom Synthesis, WeylChem InnoTec is you...

-

Product HexafluoroBenzene

We offer a wide range of product which includes HexafluoroBenzene. Contact us for more information.

-

Product Potassium tetrachloroplatinate(II)

Potassium tetrachloroplatinate(II) is a Inorganic compound with a red solid appearance. Used for preparing precious metal catalysts and coating precious metals. Important raw materials for preparing other precious metal compounds and catalysts. It is the raw material for the synthesis of cisplatin and...

-

Product 2-chloro-7-cyclopentyl-7H-pyrrolo[2,3-d]pyriMidine-6-carboxylic acid

Raw materials Ribociclib intermediate

-

Product (S)-4-Ethyl-4-hydroxy-7,8-dihydro-1H-pyrano[3,4-f]indolizine-3,6,10(4H)-trione

SY039427 is Accela one of star products, with experiences on dozens of kgs production, great quality and super cost. We offer a wide range of products which includes (S)-4-Ethyl-4-hydroxy-7,8-dihydro-1H-pyrano[3,4-f]indolizine-3,6,10(4H)-trione. Contact us for more information.

-

Product Chemicals / Intermediates for Pharma & Biopharma

Since its foundation, Midas Pharma has been offering services in sourcing and supplying of substances complying with the corresponding industry requirements and uses. Meanwhile our portfolio involves a broad range of chemicals for industrial applications, starting materials and intermediates for small mole...

-

Product Lithium aluminum hydride in THF

It is stable in dry air. It can be hydrolyzed in moist air and even cause combustion. It is soluble in diethyl ether and THF.

-

Product N-Nitroiminoimidazolidine

It is used at the intermediate of imidacloprid as a highly effective and low toxic pesticide.

-

Product Ethisterone

Hubei Sanjing Biotechnology Co Ltd offers a wide range of products which includes ethisterone. Contact us for more information.

-

Product Vaccine Adjuvant: Alhydrogel™

• Alhydrogel is a range of aluminium hydroxide gel products which have been specifically developed for use as an adjuvant in human and veterinary vaccines • The gel is a suspension of boehmite-like (aluminium oxyhydroxide) hydrated nano/micron size crystals in loose aggregates • The products have v...

-

Product CAS 1143516-05-5

We have more than 100kg available goods in stock, and this product is in pilot scale. The purity can reach more than 98.0%.

-

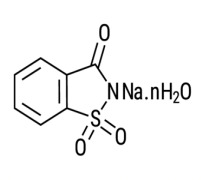

Product Sodium saccharin 6% moisture

JMC offers a wide range of products which includes sodium saccharin 6% moisture. Appearance: it is white crystals or a white, crystalline powder or colorless crystals. Packaging: 25kg carton box, 50kg fiber drum, and 1000kg super sack with inner polyethylene bag. Contact us for more information.

-

Product 2-Hydroxy methyl 3-methyl-4-[2,2,2 trifluoroethoxy] pyridine hydrochloride

INTEGRIN LIFE SCIENCES PVT. LTD. offers wide range of Intermediates which includes 2-Hydroxy methyl 3-methyl-4-[2,2,2 trifluoroethoxy] pyridine hydrochloride (Lanso Hydroxy). Contact us for more information.

-

Product 3-Aminoquinuclidine dihydrochloride

CAS:6530-09-2The company’s product range, which is constantly being developed and expanded, includes 60 finished dosage forms, 25 active pharmaceutical ingredients and more than 20 intermediates, including medicines for the nervous system, cardiovascular health, as well as antiviral, antibacterial and anti...

-

Product Phenyl Acetone

We are a manufacturer of the said product in India. For all further details please visit our website www.premierindia.co.in or email us:- info@premierindia.co.in; ashish@premierindia.co.in

-

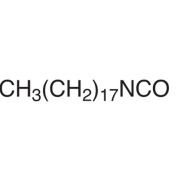

Product Octadecyl isocyanate

Structure : CH3(CH2)17NCO

MW : 296

Property Melting point : 18.5~21 ℃

Boiling point : 172~173 ℃ / 667 Pa

Flash point : 184~196℃

-

Product Sodium Hyaluronate (Hyaluronic Acid API): MW 7-250 kDa

Sodium Hyaluronat (Hyaluronan, HA): TYPE II (MW 7-250 kDa)

Very Low Molecular Weight - Pharmaceutical Grade (Injection suitable)Certificates: DMF, GMP, USP, EP

Sodium hyaluronate is a polysaccharide found in many locations in the human body, such as t...

-

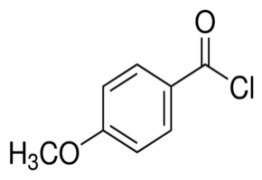

Product 4-Methoxybenzoyl chloride

4-Methoxybenzoyl chloride is one of the reactive acylating agents that can react with carboxylic acids, alcohols and amines to yield respective carboxylic anhydrides, esters and amides.

Shree Ganesh Remedies Limited is one of the leading manufacturer and supplier of 4-Methoxybenzoyl chloride [C...

-

Product Generic APIs, biocides and intermediates

An extensive portfolio of generic APIs and intermediates renowned for their quality, safety and supply securityEvonik is one of the world’s leading suppliers of high-quality generic APIs, biocides and intermediates for the pharmaceutical industry. As a global provider for generic APIs, we offer a broad por...

-

Product ETHYL ACETATE

Ethyl acetate used for pharmaceutical industry as an intermediate and solvent for crystallization. Has a high solvent power, compatible with all solvents, thinners, plasticizers, common resins. Dollmar has full availabilty of ethyl acetate in drums, ibc and bulk. https://www.dollmar.com/cms/?dollmarproduct...

-

Product CYCLAMATE (E-952)

Cyclamate´s sole European producer: Productos Aditivos.

We supply our Cyclamate mainly as excipient to the pharmaceutical industry and as additive to the food industry. We have a unique position in this market: based on our quality, reliability and service we supply worldwide to many pharmac...

-

Product Succinimide 123-56-8

Appearance:white flake crystalAssay:99%min

MP:121 to 126 deg C

Residue on ignition:0.5%max

Water:0.5%max

-

Product Outsourcing of advanced intermediates, active ingredients and formulations

With an extensive range of products and world-wide experience, Summit Pharmaceuticals Europe is able to provide integrated services for the pharmaceuticals industry, from raw materials and APIs up to finished dosage forms.

-

Product 2-CHLOROMETHYL-3,4-DIMETHOXY PYRIDINE HCL

PALECREAM COLOR CRYSTAL POWDER

300t/ year

Contact us for more information

-

Product 5-Amino-3-trifluoromethyl-pyridine-2-carbonitrile

5-Amino-3-trifluoromethyl-pyridine-2-carbonitrile573762-62-6

-

Product Expert witness and intellectual property support

Intertek offers wide range of pharmaceutical services which includes expert witness and intellectual property support for pharmaceuticals. It belongs to pharmaceutical and healthcare consulting services category. It includes expert witness and intellectual property support services, intellectual property s...

-

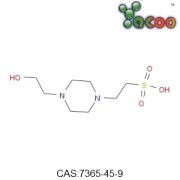

Product HEPES

English Name:4-(2-Hydroxyethyl)-1-piperazineethanesulfonic acid

Molecular Formula:C8H18N2O4S

Molecular Wt:238.31

CAS:7365-45-9 q...

-

Product 2-n-Propyl-4-methyl-6-(1-methylbenzimidazole-2-yl)benzimidazole

white to off-white crystalline powder

-

Product Sodium Isocaprylate

SIPING FINE CHEMICALS CO., LTD. Offers wide range of products which includes sodium isocaprylate. Appearance: white powder. Applications: it’s a popular salt forming agent in synthesizing antibiotics. It’s mainly used in semi-synthetic process of medicine industry, and as salt forming agent of cephalospor...

-

Product Hexamethyl Disiloxane(HMDSO)

• It can be used as a heading agent in the production of silicone oil; • raw material for silazane; • silicone rubber, pharmaceuticals, meteorological chromatography stationary liquid, analytical reagents, water repellent agent,; • etc..

-

Product Iodotrimethylsilane

• 15 years of professional product experience, patented technology

• Premium quality in pharmaceutical industry,with a content of 99.5% min.

• Leading producer in China, 500 t/a capacity, mass and stable supply capacity

As an important synthetic agent, silylated reagents,use fo...

-

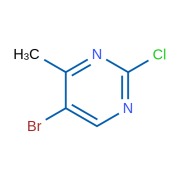

Product 6-Chloro-4-methylpyridin-2-amine

Product Name:5-Bromo-2-chloro-4-methylpyrimidineCAS NO :633328-95-7

Moluculer Weight :207.46

MDL NO :MFCD13193654

Purity/Specification:97%

Smile Code :BrC1=CN=C(N=C1C)Cl

Molecolur Formule :C5H4BrClN2

Storage :Inert atmosphere,2-8°C

-

Product Hexafluoroacetylacetone

Qi-chem co. Ltd offers a wide range of product which includes Hexafluoroacetylacetone. Contact us for more information.

-

Product (R)-1-tert -Butoxycarbonyl-3-aminopyrrolidine (R-BAMP)

・Batch scale:150kg/Batch

・Purity:over 98.5%

・Optical purity:over 99.0%ee

-

Product Calcium acetylacetonate

Physical and chemical properties

It is a white powder with a characteristic odor, stable nature and easy to react with oxidants. The pH is 10.5 (concentration of 10 g/l at 20 ° C), melting point is 270.4 ° C, and decomposition point is 277-284 ° C. Soluble in acidic water, slightly soluble in metha...

-

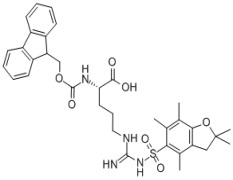

Product Fmoc-Arg(Pbf)-OH

Amino acid derivatives. Intermediate of pharmaceuticals. Purity (HPLC) > 99.0%; Optical Purity≤0.10% D-enantiomer; impurity≤0.10%

-

Product PVP (K17-K25-K30-K90)

PVP (K15-K17-K25-K30-K90) exists as powder or aqueous solution. It can dissolve in water and a variety of organic solvents. It is generally used in cosmetics, surfactants, pharmaceutical industries and other related industrial fields.

►Application: PVP-...

-

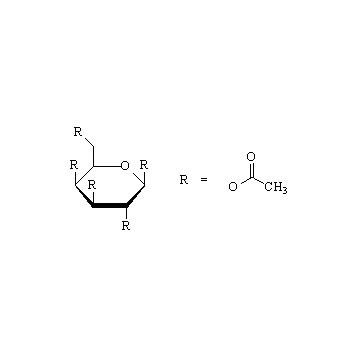

Product beta-D-galactose pentaacetate (pharmaceutical intermediate)

Galactose Pentaacetate can be used as a pharmaceutical intermediate, for synthesis products such as galactoside derivatives. Molecular Formula: C16H22O11 Molecular Weight: 390.34 Assay: NLT 98.0%

-

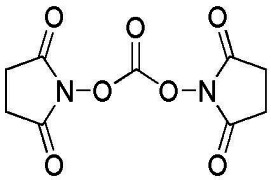

Product DSC; CAS# 74124-79-1 Peptide Coupling Reagent

Coupling Reagents of peptides; Purity(99% HPLC): 99%min;

-

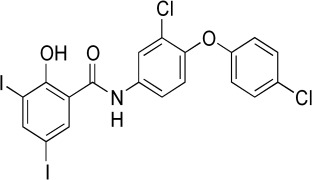

Product RAFOXANIDE

CAS No.: 22662-39-1Indication: Anthelmintic Category: Veterinary API Specifications: As per BP.VET. Description: We provide Micronized Rafoxanide in various micron sizes which is perfectly suited for use in all dosage forms with excellent stability & consistency.

-

Product L-Theanine/n-ethyl-l-glutamine 3081-61-6

Product Name: L- Theanine

CAS#: 3081-61-6

brhrbrAppearance

White crystalline powder

Specific rotation(a)D20

(C=1 , H2O )

+7.7o to +8.5o

Solubility (1.0g/20ml H2O)

Clear Colorless

Melting Point (oC)

211-216 oC

Chloride(C1)

Not more tha...

-

Product 11051-71-1 avilamycin

For the control and treatment of Necrotic Enteritis caused by Clostridium perfringens.brhrbrName:avilamycin;

CAS:0011051-71-1

Assay(Purity) or Standard:98%

MF: C20H37N3O13

-

Product "Ozagrel methylester "

Product Name Ozagrel methylester

Synonyms methyl (2E)-3-[4-(1H-imidazol-1-ylmethyl)phenyl]prop-2-enoate,2-propeno; Methyl (2E)-3-[4-(1H-imidazol-1-ylmethyl)phenyl]acrylate; Ozagrel methylester CAS RN 866157-50-8 Specification ≥98.0% Mo...

-

Product Magnesium Sulphate Pharma Grade Ep Usp Bp Gmp

Name:Magnesium SulphateCAS No.:7487-88-9 Other Names: Epsom Salt , Magnesium sulphate MF: MgSO4.7H2O EINECS No.:231-298-2 Place of Origin: Hebei, China (Mainland) Grade Standard: Medicine Grade Purity:99.9% A...

-

Product (R)-4-Hydroxy-dihydrofuran-2(3H)-one CAS: 58081-05-3

(R)-4-Hydroxy-dihydrofuran-2(3H)-one CAS: 58081-05-3

-

Product Elacestrant Intermediate: Tert-butyl N-ethyl-N-[2-(4-formylphenyl)ethyl]carbamate CAS: 2384514-21-8

Elacestrant Intermediate: Tert-butyl N-ethyl-N-[2-(4-formylphenyl)ethyl]carbamate CAS: 2384514-21-8

-

Product 6-Aminopenicillanic acid (6-APA)

6-Aminopenicillanic Acid is an essential precursor for the manufacture of Semisynthetic penicillins (e.g., ampicillin, amoxicillin, and cloxacillin). It plays a crucial role in the healthcare industry, contributing to the production of life-saving antibiotics used to treat various bacterial infections.

-

Product (R,E)-5-([1,1'-biphenyl]-4-yl)-4-((tert-butoxycarbonyl)aMino)-2-Methylpent-2-enoic acid

(R,E)-5-([1,1'-biphenyl]-4-yl)-4-((tert-butoxycarbonyl)amino)-2-methylpent-2-enoic acid is an organic compound containing a tert-butoxycarbonyl (Boc) protecting group, primarily used as a pharmaceutical intermediate. This compound introduces a tert-butoxycarbonyl group to the amino group to protect it, ens...

-

Product Theobromine

Theobromine is an intermediate for Pentoxifylline and also used in other Nutraceuticals

-

Product Phloroglucinol dihydrate

Shouguang fukang pharmaceutical co. Ltd offers a wide range of products which includes phloroglucinol dehydrateit is white or wheat rime dust. Contact us for more information.

-

Product N-Methyl-Pyrrolidone

Jiaozuo zhongwei special products pharmaceutical co. Ltd offers a wide range of product which includes n-methyl-pyrrolidone. Properties: it is colourless transparent liquid,it has strong water absorption. It can almost dissolve in all the solvents.

Uses: it is a high-selective polar solvent a...

-

Product Ferrous Gluconate

We offer a wide range of products which includes Ferrous Gluconate.

Characteristics: light yellow gray or yellow granule or powder with slight gray green.

Uses: iron is one of the major composition, which constitutes, hemoglobin, myoglobin, cellular chromatin and some tissular enzym...

-

Product Product List of intermediates

Acalabrutinib

Acyclovir

Abemaciclib

Avibactam

Avatrombopag

Apalutamide

Brivaracetam

Baloxavir

Baricitinib

Crisaborole

Copanlisib

Eluxadoline

Dolutegravir

Dapagliflozin

Elagolix

Efinaconazole

Eltrom...

-

Product Edenor(R) G 99,8 PH

Glycerine Ph. EUR / USP as pharmaceutical excipient certified according to Exipact GMP / GDP. Please contact us for more Information.

-

Product (2s,3s,5s)-2-Amino-3-Hydroxy-5-Tert Butylcarbonyl Amino-1,6- Diphenyl-Hexane

Honour Lab Limited offers a wide range of products which includes (2s,3s,5s)-2-amino-3-hydroxy-5-tert butylcarbonyl amino-1,6- diphenyl-hexane. It belongs to intermediate category. Contact us for more information.

-

Product 4-Hydroxy-L-Proline

Jingjing Pharmaceutical Co., Ltd offers a wide range of products which includes 4-Hydroxy-L-Proline. Contact us for more information.

-

Product 7-amca

Zhejiang east-asia pharmaceutical co. Ltd offers a wide range of products which includes 7-amca. It belongs to intermediate category. Contact us more information.

-

Product (2-chloro-5-iodophenyl)(4-fluorophenyl)methanone 915095-86-2

Hangzhou longshine bio-tech co ltd offers a wide range of products which includes (2-chloro-5-iodophenyl)(4-fluorophenyl)methanone 915095-86-2. It belongs to intermediate category. Contact us for more information.

-

Product Trifluoromethanesulfonic acid

Hangzhou wenlee chemical co., ltd offers a wide range of products which includes (4r)-5-methoxycarbonyl-2,6-dimethyl. It belongs to customized category. Contact us for more information.

-

Product Perfluorobutanesulfonyl fluoride

Time chemical provides wide range of products which includes diphenyl-(trifluoromethyle)-sulfonium trifluoromethancesulfonate. Packaging: 25kg/drum. Contact us for more information.

-

Product Avibactam Sodium

Zhejiang Yongning Pharmaceutical Co. Ltd offers a wide range of products which includes Avibactam Sodium. It belongs to APIs category. Storage: cool and dry , protected from light. Contact us for more information.

-

Product Aclotil tablets

Bal pharma ltd. offers a wide range of products which includes aclotil tablets. It belongs to cardiac care category. Composition: each film coated tablet contains : clopidogrel bisulphate usp equivalent to clopidogrel 75 mg. Contact us for more information.

-

Product Iodine Chemistry

Methyl Iodide - CAS 74-88-4

Iodine Monochloride 50% Solution - CAS 7790-99-0

Sodium Metaperiodate - CAS 7790-28-5

Iodotrimethylsilane (TMSI) - CAS 16029-98-4

Sodium Iodate - CAS 7681-55-2

Periodic Acid - CAS 10450-60-9

Ethyl Iodi...

-

Product Pharmaceutical Intermediates

Erythromycin Thiocyanate, 7-Aminocephalosporanic Acid (7-ACA), 7- Aminodeacethoxylcephalosporanic Acid (7-ADCA), AE Active Ester (Benzothiazolium Thioester), Thiotriazinone, DM (Ethyl Acetoacetate), 6-Aminopenicilanic Acid (6-APA), Sodium Borohydride, Potassium Borohydride, Liquid boron, Sodium Hydride, So...

-

Product Nucleotides, Nucleotide triphosphates (NTPs) & Deoxynucleotide triphosphates (dNTPs)

We develop a broad range of Nucleotides, Nucleotide triphosphates (NTPs) and Deoxynucleotide triphosphates (dNTPs).

Nucleotide diphosphates:

Uridine 5'-diphosphate disodium salt (UDP);

Guanosine 5'-diphosphate disodium salt (GDP);

Cytidine 5'-diphosphate disodium salt (CDP...

-

Product Potatassium Borohydride

Potassium borohydride is used in synthesis as aselective reducing agent. A very selective reducing agent, it will only reduce ketones or aldehydes to their corresponding alcohols. It is used to synthesize chloramphenicol, vitamin A, thiopenicol, atropine, and scopolamine. It differs from other borohydrides...

-

Product Ethyl cyanoglyoxylate-2-oxime

Zhejiang Hisoar pharmaceutical is global manufacturer and supplier of Coupling Reagent for Peptide .Contact us for more information.

-

Product Sulfadoxine

Chongqing Kangle Pharmaceutical Co. Ltd. provides wide range of pharmaceutical products which includes linocaine base. It belongs to intermediate for api categoryproperties: white needle-like crystals. Soluble in alcohol, ether, benzene, chloroform and oils, insoluble in water. Use: for quetiapine fumarate...

-

Product Ezetimibe

Zhejiang Tianyu Pharmaceutical Co. Ltd offers a wide range of product which includes (s,e)-methyl 2-(3-(3-(2-(7-chloroquinolin-2-yl)vinyl)phenyl)-3-hydroxypropyl)benzoate (intermediate of montelukast). It belongs to pharmaceutical intermediates category. Contact us for more information.

-

Product Tofacitinib Citrate

Kekule pharma offers a wide range of intermediates which includes cTofacitinib. It belongs to Anti Inflamatory category. Contact us for more information.

-

Product 1-bromo hexadecane

Yancheng Longshen Chemical Co.,Ltd offers a wide range of products which includes 1-bromo hexadecane. It belongs to Halogenated Hydrocarbons category. Appearance: Dark yellow liquid. Contact us for more information.

-

Product SUZETRIGINE

Suzetrigine(VX-548) is an orally active and specific NaV1.8 inhibitor. Suzetrigine has analgesic activity and can be used to study acute pain and neurotransmission.As compared with placebo, VX-548 at the highest dose (a 100-mg oral loading dose of VX-548, followed by a 50-mg maintenance dose every 12 hours...

-

Product Gallic acid

Name: Gallic acid

Alias: 3,4,5-trihydroxybenzoic acid

Usage:

1: Medicine:It has the effect of astringent, hemostasis and diarrhea which widely used in antibacterial, antiviral and antitumor drugs.

2. Industrial:

(1)It is used in the production of permanent blue ... -

Product 2-[[2-[(6-Bromohexyl)oxy]ethoxy]methyl]-1,3-dichlorobenzene

Vilanterol Trifenatate Intermediate

-

Product 2-Chloro-4,6-Dimetoxy-1,3,5-Triazine (CDMT)

Changzhou Foreign Trade Corp offers a wide range of products which includes 2-Chloro-4,6-Dimetoxy-1,3,5-Triazine(CDMT). Contact us for more information.

-

Product 2,3,4,6-Tetra-O-Benzyl-D-Galactose

Characteristics: It is white or off-white solid, it is insoluble in water ,but easily soluble in chloroform.

-

Product Advanced Intermediates

Within our Advanced Intermediates portfolio, we provide fine chemicals and advanced intermediates, such as pyridines and piperidines, Ketene derivatives, phase-transfer catalysts, fluorine compounds, and others, as well as customer-specific products, for a wide range of applications and market segment...

-

Product Nilotinib HCl

Suzhou Lixin Pharmaceutical Co Ltd offers a wide range of products which includes (r)-boroleu-(+)-pinanediol-hcl. It belongs to intermediates category. Contact us for more information.

-

Product 4-Nitrobenzaldehyde

Neostar offers a wide range of products which includes 4-Nitrobenzaldehyde. It belongs to apis intermediates category. Contact us for more information.

-

Product Telmisartan

Jiangsu zhongbang pharmaceutical offers a wide range of products which includes 2-chloromethyl-4-methoxy- 3,5-dimethyl pyridine. It belongs to Intermediate Category. Usage: OmeprazoleIntermediates. Contact us for more information.

-

Product Canrenone

Zhejiang shenzhou pharmaceutical offers a wide range of products which includes Canrenone. Contact us for more information.

-

Product 2,4-Xylidine

Hebei dapeng pharm and chem oc. Offers a wide range of products which includes 2,4-Xylidine. It belongs to dimethylaniline category. Appearance: Colorless or light brown liquid. Packing: The 200KG/steel barrel. Contact us for more information.

-

Product Diethylacetamidomalonate(DEAM)

Changzhou united chemical co. Ltd offers awide range of products which includes Diethylacetamidomalonate(DEAM). It belongs to fine chemical & chrial reagents category. Contact us for more information.

-

Product DL-Carnitine HCl

Liaoning Koncepnutra Co., Ltd. offers wide range of pharmaceutical products which includes dl-carnitine hcl. Characteristic: white powder, it is very soluble in water. Applications: mainly suitable for feed products. Packing: 10kg/ 25kg fiber drum. Contact us for more information.

-

Product BROMINE DERIVATIVES, PHASE TRANSFER CATALYSTS, Intermediates, Lithium Compounds

BROMINE DERIVATIVES Liquid Bromine N-Propyl Bromide Sodium Bromide Powder / solution 45% N-Butyl Bromide PHASE TRANSFER CATALYSTS Tetrabutylammonium Bromide (TBAB) Triethylbenzylammoniun Chloride (TEBAC) Tetrabutylammonium Hydrogen Sulphate (TBAHS)LITHIUM COMPOUNDS Lithium Bromide Lith...

-

Product (-)-2-[4-[(4-chlorophenyl)phenylmthyl]-1-piperazinyl]ethanol dihydrochloride salt

Hunan warrant pharmaceutical co., ltd offers a wide range of products which includes (-)-2-[4-[(4-chlorophenyl)phenylmthyl]-1-piperazinyl]ethanol dihydrochloride salt. It belongs to chemicals and main intermediates category. Contact us for more information.

-

Product (3S,4S)-3-((R)-(tert-Butyldimethyl-silyloxy)ethyl)- 4((R)-carboxyethyl)-2-azetidinone 4-BMA

Zhejiang jiuzhou pharmaceutical co. Ltd offers a wide range of products which includes (3s,4s)-3-((r)-(tert-butyldimethyl-silyloxy)ethyl)- 4((r)-carboxyethyl)-2-azetidinone 4-bma. It belongs to intermediates category. Contact us for more information.

-

Product CIL Products

CIL specializes in the process of labeling biochemical and organic compounds with highly enriched, stable (nonradioactive) isotopes of carbon, hydrogen, nitrogen and oxygen. Our chemists substitute common atoms (e.g., 1H, 12C, 14N, 16O) with rare, highly valued isotopes (e.g., 2H o...

-

Product L-Thi

Specific amino acid form used in peptide constitution.

From our Korean Partner Amino logics Co., Ltd.

-

Product Poly Phosphoric Acid

Poly Phosphoric acid (PPA) is widely employed as acylation reagent In various reactions. It is a strong mineral acid with excellent dehydrating propertie.

What is a pharmaceutical intermediate?

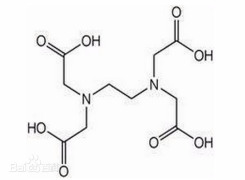

Pharmaceutical intermediates are fine chemicals of intermediate compounds that are produced in the process of manufacturing active pharmaceutical ingredients (APIs). Intermediates are the by-products of reactions in the API production process. Each reaction during the production process may produce several intermediates depending on the analysis, and these intermediates can serve as precursors to other active pharmaceutical ingredients. The conversion of intermediates to active ingredients can be achieved through further refinement processes. Like APIs, intermediates can also be used in bulk drugs for therapeutic purposes.

Difference between an API and an Intermediate

How does an API differ from a pharmaceutical intermediate? These terms may be confused and used interchangeably, especially by newbies in the pharmaceutical industry. Although APIs and intermediates are both pharmacologically active, they differ in function, composition and structure.

What are the major differences between API and Intermediates?

Many factors and analysis differentiate active ingredients and chemical compound from pharmaceutical intermediates. Active ingredients and speciality chemicals are the final products of raw materials, while chemical intermediate make up the by-products produced during the manufacturing process of APIs. Unlike APIs, which are usually safe and administered for therapeutic purposes after due research, intermediates may either be therapeutic, toxic or even APIs. However, APIs produced as by-products that are not officially approved, cannot be administered or used as active ingredients. Also, intermediates do not need to be approved or regulated to be utilized, unlike active ingredients that contain specialty chemical.

What is API in pharmaceuticals?

APIs – Active pharmaceutical ingredients, are the active substances or combination of active substances contained in drugs, that produce the intended pharmacological, biological or therapeutic effect. They serve as the active ingredient of drugs and provide pharmacological activity, or aid diagnosis, treatment, cure, mitigation, or prevention of diseases. Drugs are primarily made up of active pharmaceutical ingredients as the core, and excipient which are either inert or biologically inactive.

Innovations in pharmaceutical intermediates

The pharmaceutical industry is continuously evolving and reshaping itself. Several pharmaceutical companies and market players are adapting innovations in pharmaceutical intermediate sales as the demand for them is rapidly increasing. The growing demand is as a result of several factors such as the surge in chronic diseases, etc., and this has positively impacted the global pharmaceutical intermediate market size. As drug making activities increase around the globe, innovations are being birthed, and the demand for pharmaceutical intermediates manufacturers is on the rise. Due to the implementation of regulated drug-making activities, good manufacturing practices (GMP) in pharmaceutical companies, the global pharmaceutical and packaging market has experienced a surge.

What trends have driven innovations in pharmaceuticals intermediates?

Based on reports, in 2018 forecast period, the global pharmaceutical intermediates market share had an estimated gross margin value of US $ 27, 356.1 million. Its estimated value is anticipated to reach US$38,457.2 million by 2024, with a CAGR of 6.1%, during the 2019-2024 forecast period. Top manufacturers are continually making massive investments into pharmaceutical researches and the development of new pharmaceutical intermediates. Alongside other trends, this gives the market an added advantage.

Some other significant trends driving innovations and growth rate of the global pharmaceutical market size include the rising demand for generic drugs, increasing prevalence of chronic and terminal diseases, patent expiry, and the increasing production of APIs, and intermediate operation among others.

How have pharmaceutical intermediates developed?

Given the massive growth of the market, investments into research, and the continuously advancing biotechnology, pharmaceutical intermediates have experienced some significant developments over the past few years. New intermediates are being discovered, as well as new product development and manufacturing processes such as continuous flow process. These discoveries have made intermediates safer and potent for consumption and have also established new scopes of application.

What are the challenges to pharmaceutical intermediates market growth?

Just as there are key trends motivating innovations and growth of the global pharmaceutical intermediate market, there are also trends that present as challenges. Strict regulatory policies for one, serve as significant setbacks to the growth rate of this market size. Also, strong competition between companies in the industry as well as pricing challenges are adversely affecting the growth of the global pharmaceutical intermediate market. Also, in recent times, the COVID-19 pandemic has also affected pharmaceutical intermediates sales and market share growth.

Top manufacturers of pharma intermediates

The pharmaceutical ingredient market share has a broad pool of competitor pharmaceutical companies at different levels. However, some have strategically worked their way to becoming a top API manufacturer of pharma intermediates in the pharmaceutical industry. These leading manufacturers have played vital roles in the growth of the global intermediate market through stocks. Some of these manufacturers include Aceto Corporation, Vertellus Holdings LLC, Dishman Group, Cycle Pharma, Sanofi Winthrop Industries SA, BASF SE, Teva Pharmaceuticals, AR Life Sciences Private Limited, Midas Pharm etc.

Where can you find the top manufacturers of pharma intermediates?

Although pharmaceutical intermediates are manufactured in several countries and regions across the globe, there are focal points where top manufacturers are located. These regions contribute some of the largest quotas to the growth of the intermediate pharmaceutical market. The major regions include Asia Pacific, North America, Latin America, MEA, and Europe, with the expectance that North America will contribute the largest to the market revenue in the near future.

In addition to this, Asia Pacific and Latin America are also expected to influence the market's growth positively. There are anticipations that top manufacturers in Japan, China, and India will also impact market growth positively.

What do the top manufacturers of pharma intermediates have in common?

Most top players in the pharma intermediate global market have a lot of things in common, keeping them at the top of the supply chain and contributing to the growth rate of the worldwide market. Top manufacturing companies of pharmaceutical intermediates make massive investments into innovations, research, and new pharma intermediate development. They take advantage of recent market trends, rising demands, and opportunities to produce relevant pharmaceutical products. Top manufacturers are consistently evolving with time and technology, and they partake in industry consolidation.

Which supplier selection criteria are relevant for drug intermediates and API?

The majority of pharmaceutical giants outsource for APIs and drug intermediates for drug development. Given this, the competition among manufacturers is too high, and this can affect company evaluation and selection of the right suppliers. The wrong choice of suppliers can negatively influence the supply chain performance and overall performance of the pharmaceutical company.

Therefore, factoring supplier selection criterion before making purchases is essential. Some of the most important criteria for selection of API and drug intermediate suppliers include regulatory compliance (DMF status), cost, quality, supplier profile, risk, reliability, and financial profile of the supplier.

Key players of the pharmaceutical intermediates market

The pharmaceutical intermediates market comprises of many key players who have positively impacted the growth of the global market. Although some of these manufacturing companies independently produce pharma intermediates, a few others handle the production and development of intermediates as well as APIs.

Who are the key players in the global active pharmaceutical ingredients (APIs) market?

The global pharmaceutical market comprises a variety of pharma products in the pharmaceutical industry. APIs are one of the most prominent products, and several top manufacturing companies are key players in the active pharmaceutical ingredients market. Some of these key players include Pfizer Inc., Novartis International AG, Teva Pharmaceuticals, Aurobindo, Sun Pharmaceutical Industries Ltd., etc.

What factors have determined who the key players in the pharmaceutical intermediates market are?

Several factors have influenced and determined who the key players in the pharmaceutical intermediates market within different forecast period. These factors apply everywhere, regardless of the location of these top manufacturing companies. Factors that determine the key players include demographics or population science, technology, social behaviour and culture of the local community, politics (local, national and international), national and global regulating laws and policies, and the natural environment (raw material, pollution, energy prices, biotechnology), etc.

What are the differential strategies adopted by the key players to hold a significant share in the global pharmaceutical intermediates market?

Top manufactures of pharma intermediates have achieved their growth through the acquisition of smaller or other pharma – related companies and via mergers to establish their presence in the market. Also, top pharmaceutical intermediate companies are expanding their businesses through product portfolio expansion and development across the globe. Through these strategies, these key players can maintain a significant share in the global pharmaceutical intermediates market.

References

Upcoming Events

-

CPHI Americas 2025

Pennsylvania Convention Center, Philadelphia

20 May 2025 - 22 May 2025 -

CPHI & PMEC China 2025

Shanghai New International Expo Center

24 Jun 2025 - 26 Jun 2025 -

Pharmaceutical Industry Webinars

-

Webinar “New World” Processing with Advanced Configurable Process Plants

-

14th May 2025

-

3pm GMT /4pm CET

-

-

Webinar An Untapped Market in Gender Inclusivity and Equity

-

19th March 2025

-

3pm GMT /4pm CET

-

-

Webinar Pathway to $10/g Biologics Production: Reshaping the Biomanufacturing Landscape

-

18th February 2025

-

3pm BST /4pm CET

-

-

Webinar Leveraging Real-Time Clinical Data to Deliver Certainty in Solubility Enhancement and Modified Release Development

-

12th December 2024

-

3pm BST/ 4pm CET

-

-

Webinar The CPHI Sustainability Collective: A New Initiative to Support a Sustainable Pharma Value Chain

-

10th December 2024

-

3pm BST /4pm CET

-

-

Webinar Key to Success: A CDMO's Pathway to Biologics Excellence

-

5th November 2024

-

3pm BST/ 4pm CET

-

-

Webinar The Changing Dynamics of Global API Manufacturing

-

17th September 2024

-

3pm BST/ 4pm CET

-

-

Webinar Shaping the Future of Italy’s Pharma Market: Trends and Opportunities

-

4th September 2024

-

4pm CET/ 10am EST

-

-

Webinar Fragment-Based Oligonucleotide and Oligopeptide Synthesis

-

30th Jul 2023

-

4pm CET / 10am EST

-

-

Webinar GMP Rationale for Sterile High-Potency/Toxic Pharmaceuticals

-

18th June 2024

-

4pm CET / 10am EST

-

-

Webinar Unlocking Opportunities in the Growing Pharma Landscape of The Middle East

-

5th June 2024

-

3pm CET / 9am EST

-

-

Webinar Exploring Technological Trends in the Future of Pharmaceutical Manufacturing

-

23rd May 2024

-

4pm CET / 10am EST

-

-

Webinar Achieving Manufacturing Excellence Through Digital Transformation

-

16th April 2024

-

4pm CET / 10am EST

-

-

Webinar Made in Africa: What’s Driving Pharma Manufacturing

-

28th March 2024

-

4pm CET / 10am EST

-

-

Webinar Case Study: Risk Management for Annex 1 Sterile Production EMS

-

28th February 2024

-

4pm CET / 10am EST

-

-

Webinar Innovative Strategies for B2B Pharma Marketeers: Driving Value through Content

-

20th February 2024

-

4pm CET / 10am EST

-

-

Webinar Revolutionizing Pharma: Data and AI Unleashed

-

18th January 2024

-

4pm CET / 10am EST

-

-

Webinar Optimal Temperature: Elevating Biologics Cold Chain Excellence

-

16th January 2024

-

4pm CET / 10am EST

-

Recently Visited

Position your company at the heart of the global Pharma industry with a CPHI Online membership

-

Your products and solutions visible to thousands of visitors within the largest Pharma marketplace

-

Generate high-quality, engaged leads for your business, all year round

-

Promote your business as the industry’s thought-leader by hosting your reports, brochures and videos within your profile

-

Your company’s profile boosted at all participating CPHI events

-

An easy-to-use platform with a detailed dashboard showing your leads and performance

Grey-Overlay%20(1).jpg)

.jpg)

%20(2).jpg)

.jpg)

.jpg)

.jpg)

![Triphenylphosphine (TPP) [CAS# 603-35-0]](https://www.cphi-online.com/46/product/08/35/56/picture.jpeg)

![2-(3-Chloropropyl)-2, 5, 5-trimethyl -[1, 3]-dioxane](https://www.cphi-online.com/46/product/129/84/24/p0th_S.jpg)

![Guanine [73-40-5]](https://www.cphi-online.com/46/product/129/72/18/p0th_S.jpg)

![sodium 2-{4,7,10-tris[2-(tert-butoxy)-2-oxoethyl]-1,4,7,10-tetraazacyclododecan-1-yl}acetate](https://www.cphi-online.com/46/product/128/93/59/p1289359th_S.jpg)

![1-[(tert-butoxy)carbonyl]azetidine-3-carboxylic acid](https://www.cphi-online.com/46/product/126/17/70/picture.png)

![(2S)-2-(8-amino-1-bromoimidazo[1,5-a]pyrazin-3-yl)-1-Pyrrolidinecarboxylic acid phenylmethyl ester](https://www.cphi-online.com/46/product/128/94/02/p0th_S.jpg)

![2-chloro-7-cyclopentyl-7H-pyrrolo[2,3-d]pyriMidine-6-carboxylic acid](https://www.cphi-online.com/46/product/68/69/17/p686917th_S.jpg)

![(S)-4-Ethyl-4-hydroxy-7,8-dihydro-1H-pyrano[3,4-f]indolizine-3,6,10(4H)-trione](https://www.cphi-online.com/46/product/96/94/28/p969428th_S.jpg)

![2-Hydroxy methyl 3-methyl-4-[2,2,2 trifluoroethoxy] pyridine hydrochloride](https://www.cphi-online.com/46/product/107/82/16/p1078216th_S.jpg)

![Elacestrant Intermediate: Tert-butyl N-ethyl-N-[2-(4-formylphenyl)ethyl]carbamate CAS: 2384514-21-8](https://www.cphi-online.com/img/v2021/product_image.png)

.png)

.png)

.png)

.png)

.jpg)