- Home

- Excipients (Products)

CPHI Online is the largest global marketplace in the pharma ingredients industry

-

Products551,744

-

Companies7,781

-

Articles11,636

-

Events8

-

Webinars342

Excipients (Products)

Excipients (Products) Companies (308)

Excipients (Products) News

-

News How to disrupt an industry as big as pharma for the better?

In this interview, hear from Matthew Wise, Head of Data at CCD Partners, on the companies they've been looking into that are offering new and interesting perspectives that have the potential to shake up the pharmaceutical industry, and how they'...25 Oct 2024 -

News What can you expect from CPHI Milan 2024?

CPHI Milan 2024 marks the 35th anniversary of CPHI. The 35th Edition of the show, taking place 8–10 October, promises to be a celebration of everything pharma, covering every sector, and featuring thought leaders and trailblazers shaking up the i...25 Jul 2024 -

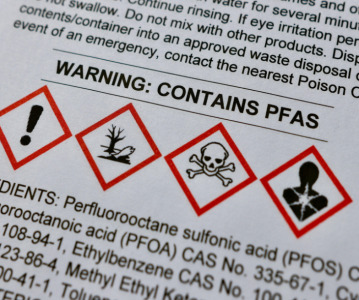

News How are new PFAS regulations impacting excipient manufacture? – CPHI North America Interview

In another interview from CPHI North America in Philadelphia in May, Peter Schmitt from Montesino Associates talks about his presentation on 'Navigating the Waters of Change: The Impact of New PFAS Regulations on the Manufacture of Excipients ...4 Jul 2024 -

News The CPHI North America agenda - see what's in store

CPHI North America will once again be held in Philadelphia this May. Philadelphia has been home to CPHI North America for several years and continues to be a hub for the US pharmaceutical market.21 Mar 2024 -

News CPHI Podcast Series: What to expect from novel excipients?

In this month's episode of the CPHI Podcast Series, Digital Editor Lucy Chard is joined by Nick DiFranco, the Global Market Manager for Novel Pharmaceutical Excipients at Lubrizol Life Science to discuss the ins and outs of excipients, how the...29 Feb 2024 -

News galenIQ: a brand of Beneo

The number one provider for medicated lozenges. Hard-boiled lozenges with galenIQTM 900 - the sweet filler-binder.23 Aug 2023 -

News Roquette expands plant-based excipient portfolio with Crest Cellulose acquisition

Crest Cellulose, an Indian excipient manufacturer, has been acquired by plant-based pharmaceutical excipient provider Roquette in a bid to increase the latter’s presence in the Asia Pacific region.4 Oct 2022 -

News Dr. Paul Lohmann® - Your Partner for high value Mineral Salts

With our expertise in the chemical and physical modification of Minerals and our customer-oriented philosophy, we are the ideal partner to turn your ideas into reality. Meet us at CPHI stand #110F50!27 Sep 2022 -

News Accepting novel excipients for innovative drug development

With the rapid development and manufacturing of new drugs and therapeutics being pushed through the pipeline, excipient manufacturers are navigating a challenging landscape to meet the demand for new and novel excipients.30 Aug 2022 -

News CPHI Podcast Series: The importance of novel excipients for innovative drug development

The latest episode in the CPHI Podcast Series dives into the world of novel excipients and explores their importance for innovative drug development.2 Aug 2022 -

News Hovione and Zerion Pharma collaborate to commercialise low drug solubility solution

By joining forces, the two companies will be able to bring Dispersome to the market faster for novel drug development22 Feb 2022 -

Sponsored Content Croda: Solutions for Your High Value Drug Products

Formulating a drug for parenteral delivery comes with its fair set of challenges. Aside from a high level of sensitivity to external factors like light and heat exposure, these large and complex drugs are prone to degradation when exposed to various ch...11 Feb 2022 -

News UPDATED: COVID-19 Vaccine and Therapeutic Development Tracker

The latest coronavirus updates and developments impacting the global pharmaceutical supply chain. Includes the latest news surrounding the therapeutic developments, updates to vaccines and boosters, and the global pharmaceutical regulations that need t...23 Aug 2024 -

News Roquette to advance drug delivery research with new US Innovation Center

The new facility will focus on the research of excipients for oral dosage forms, drug delivery systems, nutraceutical APIs and innovative pharma ingredients14 Dec 2021 -

News CPHI releases Pharma Trends 2022 report

CPHI has launched its forward-looking pharma trend report for 2022 and it is now available to read on CPHI Online.6 Dec 2021 -

News CPHI Podcast Series: Annual Report 2021 Roundtable

In this special edition podcast, Informa Markets pharma editor Gareth Carpenter speaks to Bikash Chatterjee, CEO at Pharmatech Associates and Dan Stanton, Editor and Founder at BioProcess International about some of the findings in the recently pu...23 Nov 2021 -

News CPHI Worldwide is back, and this time it’s hybrid

A new in-person and online edition of CPHI Worldwide, transforming your event experience.1 Nov 2021 -

Sponsored Content CPHI Webinar: Develop ODTs in a FLASH with UltraBurst™ - Watch On Demand

Catch up on the latest trends and developments in orally disintegrating tablet (ODT) formulation development30 Sep 2021 -

Sponsored Content IFF Pharma Solutions: Paving the Way for Superior Suspensions

Shawn Branning, Global Strategic Marketing Manager at IFF – Pharma Solutions30 Sep 2021 -

News The Top Ten CPHI Discover Company Showcases

CPHI Discover (May 17-28) gave Pharma companies, suppliers and service providers the opportunity to keep potential buyers and partners abreast of the latest news, product information and market trends in the form of free-to-access, downloadable content...3 Jun 2021

Excipients (Products) Products (2500+)

-

Product Excipients

Alchimica offers a wide range of high-quality excipients, available also in small volumes. Request a printed brochure or download it at www.alchimica.cz/en/brochures.

-

Product Specialty Excipients & Ingredients Portfolio

High-quality specialty excipient portfolio – including GMP-compliant vitamins and vitamin derivatives, as well as flavors and taste modulators – can provide solutions to help overcome even the most difficult formulation challenges.

-

Product PEARLITOL® CR-H Co-processed Mannitol-HPMC

PEARLITOL® CR-H co-processed mannitol HPMC is a direct compression excipient providing functional properties of binder as well as controlled release to your tablet. PEARLITOL® CR-H can be used in both pharmaceutical and nutraceutical oral dosage forms.

-

Product Sucrose (Low endotoxin 0.2EU/g)

This is high quality Sucrose with low endotoxin (0.2EU/g) originally from Hokkaido Japan. The specification criteria meets Japanese Pharmacopeia that can safely use in Pharma industry.

-

Product Grape Seed Extract - Raw material is import from France

Vivian What's App/Mob: +86 13142188019 Tel: 001-9093202087 Skype: vivianxie1314 Email: [email protected] Certificate of Analysis Grape Seed Extract Extract Solvent: Water ITEM SPECIFICATION RESULT STANDARD REFERENCED ...

-

Product PURA Series Microcrystalline Cellulose (MCC)

Enhance product performance with sustainable, pure and high quality PURA Series MCC:

• Nitrite below detection limit • Highest purity • Nitrite below detection level • Negligible black spots • Different particle sizes • Different bulk densities • Ultimate flowability • Spherical par...

-

Product Magnesium oxide

MAGNESIA GmbH provides a wide range of mineral raw materials which includes Magnesium oxides. Contact us for more information.

-

Product Citric Acid Anhydrous

Citric Acid Anhydrous

• Acidifying agent • Buffering agent • Chelating agent • Tablet disintegrant Jungbunzlauer’s products support the development of drugs and supplements in the pharamceutical industry and play an important role in the composition of a variety of prescription drugs and over th...

-

Product NOVOMIX Range

NOVOMIX,NOVOMIX-GEN,

NOVOMIX-MR,

NOVOMIX-ENT,

NOVOMIX-SP,

NOVOMIX-TR,

NOVOMIX-GLOW,

NOVOMIX-FAST,

NOVOMIX-MC,

NOVO-LEACH,

NOVO-SHINE

NOVOMIX-TF

-

Product Swellcal® - Calcium CMC (US-DMF No : 032865) (Carmellose Calcium)

Calcium CMC is calcium salt of Carboxy Methyl Cellulose. It is also popularly known as Carmellose Calcium and carboxymethylcellulose Calcium.

Calcium CMC ( Carmellose Calcium ) is highly pure white powder used for tablet disintegration.

Carboxymethylc...

-

Product QS-21

QS-21 is an isomeric saponin extracted from the bark of the soap tree (Quillaja Saponaria). It consists of one or more hydrophilic glycoside groups connected to lipophilic triterpenoid derivatives, and contains about 65% QS-21-apiose and 35% QS-21-xylose. Its function is to stimulate antibody-based and cel...

-

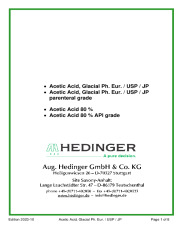

Product Acetic Acid, Glacial Ph.Eur./USP/JP ( 80%, 80% API, parenteral grade)

Hedinger offer a range of pharmaceutcial excipients, mainly solvents like Acetic Acid, Glacial Ph.Eur./USP/JP.

Production of Acetic Acid by INEOS Acetyls UK Ltd., Hull, UK in a dedicated manufacturing unit. Intermodal bulk transport in dedicated ISO tank container on behalf of Hedinger.

The manufactu...

-

Product Compressible Sugar

Customized compressible sweetener

Compressible Sugar is made by boiling granulation process with the good tableting performance. It meets the current standards of compressible sugar in every pharmacopoeia and CP. Less moisture absorbing and hardening during long-term...

-

Product PVP K-Series (Povidone)

PVP K12 PVP K17

PVP K25

PVP K30

PVP K90

Povidones

Polyvinylpyrrolidone

SynVidone K-Series

-

Product MPLA (Monophosphoryl Lipid A)

MPLA (Monophosphoryl Lipid A) refers to monophosphoryl lipid A, an effective, safe and non-toxic vaccine adjuvant. It is a highly specific TLR4 agonist that can activate the natural immune response, induce the production of cytokines, and increase the antigen uptake, antigen presentation and activation of ...

-

Product Disintequick™ ODT

Disintequik™ ODT is a co-processed excipient designed for direct tabletting operations for use in orally dissolving tablets, in that the tablet is designed to be dissolved on the tongue rather than swallowed whole. An additional convenience is that the tablet can be taken without water. It can be blended w...

-

Product Hydrogenated Phosphatidyl Choline

1,2-Didecanoyl-sn-glycero-3-phosphocholine 3436-44-0; 1,2-Dilauroyl-sn-glycero-3-phosphocholine 18194-25-7; 1,2-Dimyristoyl-sn-glycero-3-phosphocholine 18194-24-6; 1,2-Dipalmitoyl-sn-glycero-3-phosphocholine 63-89-8; 1,2-Distearoyl-sn-glycero-3-phosphocholine 816-94-4; 1,2-Diarachidoyl-sn-glycero-3-ph...

-

Product Mannitol

Qingdao Bright Moon Seaweed Group Co,Ltd provides wide range of raw materials including Mannitol. We are the earliest domestic manufacturer of mannitol in China, including industry, food, pharmaceutical excipient and API. Contact us for more information.

-

Product Sodium Caprylate (USP-NF, BP, Ph. Eur., ChP) low endotoxin, IPEC grade CODE 636454

https://www.itwreagents.com/iberia/en/product/sodium-caprylate-usp-nf-bp-ph-eur-chp-low-endotoxin-ipec-grade/636454

-

Product BENTONITE

Bentonite Powder FCC is a high-quality bentonite product sterilized using Gamma or ETO methods to ensure safety and purity. It adheres to the Food Chemicals Codex (FCC) specifications, making it suitable for applications that require stringent quality control. The product is packaged in 25 kg bags, ensurin...

-

Product Synthetic Lipids

VAV Lipids specializes in the production of cGMP Phospholipids & Lecithins from Natural sources (Soybean, Sunflower, Egg) and Synthetic Lipids. VAV also produces other Specialty Lipids like Glycerophosphocholine (GPC), Cholesterol as well as Phospholipid based Delivery Systems. Our products find appli...

-

Product Calcium Carbonate Powder USP/EP/BP/IP & FCC (Available in GCC & PCC Grades)

Calcium Carbonate Powder As per USP/EP/BP/IP & FCC

Available in GCC & PCC Grades

-

Product Carbopol® Polymers

For over six decades, the pharmaceutical industry has utilized multifunctional Carbopol® polymers for developing differentiated drug product innovations. Today, the Carbopol® polymer range continues to provide highly effective controlled-release properties for oral tablets at ...

-

Product Pharmaceutical Grade Polyethylene Glycol 400

Polyethylene glycol is widely used in various preparations, such as injection, local preparation, eye preparation, oral and rectal preparations.

At the solid level, Polyethylene glycol can be added to the liquid polyethylene glycol to adjust the viscosity for local ointments.

Polyethylene glycol ...

-

Product Polyethylene Glycol,(Macrogol),PEG(300,400,600,1000,1500,3350,4000,6000,8000)

Polyethylene Glycol,(Macrogol),PEG(300,400,1500,3350,4000,6000,8000)

-

Product Pharmatose® 200M

DFE Pharma offers a wide range of milled and sieved lactose products, including the Pharmatose® and Lactochem® brands. Varying degrees of particle sizes can be offered to allow pharmaceutical companies to choose the grade best fitting their formulation needs. Milled lactose compacts well due t...

-

Product Lactalpha 200

Lactalpha 200 is a 200 Mesh pharmaceutical grade milled lactose conforming with the lactose monohydrate monograph of the current Pharmacopoeias (Ph. Eur., USP-NF and JP). Lactalpha 200’s fine mesh enables it to be used as a binder or diluent for tableting after dry or wet granulation, along with guara...

-

Product EASYSEAL®

A new era of softgel production has begun. EASYSEAL® is a unique solution that enables manufacturers to optimize their process in one easy step. By switching to new EASYSEAL® gelatin, you can enjoy significant reductions in leakers, lower processing costs and higher quality end products.

S...

-

Product Controlled Release

Colorcon offers an enhanced portfolio of polymers for controlled release drug delivery systems along with application expertise to meet customers’ formulation needs and help speed their products to market.

-

Product SANAL® P+ Pharmaceutical Sodium Chloride (API)

SANAL® P+ Sodium Chloride Pharmaceutical Quality is for specific market requirements (eg. the Chinese and Russian markets) as active ingredient in both parenteral and peritoneal solutions and a base material for hemodialysis and hemofiltration solutions as well as other pharmaceutical applic...

-

Product Low-substituted hydroxypropyl cellulose/LHPC

Anhui Sunhere Pharmaceutical Excipients offers wide range of pharmaceutical products which includes maize starch/corn starch. Packaging: 25kg/kraft bag; 25kg/fiber drum. Main purpose: tablet and capsule diluent;tablet and capsule disintegrant;. Contact us for more information.

-

Product Methyl Beta Cyclodextrin

In medicine field

1.Methyl-Beta-Cyclodextrin can increase the solubility of the medicine and biological availability

2.Also add up the good effect and decrease the dose.

3.Methyl-Beta-Cyclodextrin can control or adjust the reactive speed, lower the drug toxicity and enhance...

-

Product LACTOSE (80M, 200M, ANHYDROUS)

PHARMALACT® 200M is finely milled α-lactose monohydrate powder meticulously manufactured by Pfeisinger GmbH. This product, defined by its 200-mesh particle size, redefines excellence in tablet manufacturing through optimal compaction and blending properties.PHARMALACT® 80M, a coarse free-flow...

-

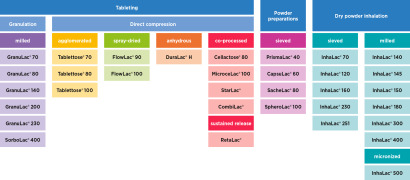

Product Lactose Product Portfolio

MEGGLE has it: The Right Lactose Product for all Needs

The world of lactose is our whole world. With this in mind, our products are aligned specifically to your needs and applications. For further information on any product shown here, please see the detailed, individual product brochure ava...

-

Product MANNITAB™ SD1

Mannitol powder

Binder for direct compression

USP/NF, Ph. Eur., BP, IP

Particle size: 100 µ

-

Product Primary Pharmaceutical Reference Standards and Reference Material Management Services

Discover our extensive range of high-quality pharmaceutical reference standards:

- Over 6,000 APIs, excipients and impurities for qualitative and quantitative applications

- Many APIs & excipients ISO 17034 accredited

- 95% ready to ship

- Comprehensive CoA...

-

Product Dispersome® Technology

Dispersome®️ – A green technology for drugs

The Dispersome® technology uses high quality whey protein, an environmentally friendly by-product from cheese production, to improve the solubility and bioavailability of poorly soluble drugs.

To watch explanatory Dispersome...

-

Product Tacrolimus capsule

Hangzhou Zhongmei Huadong Pharmaceutical provides wide range of pharmaceutical products which includes tacrolimus capsule. It belongs to formulation category. Indication: for prevention of transplant allograft rejection after liver or renal transplantation. For treatment of transplant allograft rejection f...

-

Product A-Tab® MD

A-Tab® MD is a co-processed multifunctional excipient that enhances compressibility and simplifies formulations in pharmaceutical and nutraceutical tablets. Improve tablet integrity and hardness, increase manufacturing efficiency, and create smaller tablets with A-Tab® MD (Dicalcium Phosphate Anh...

-

Product Ethyl Oleate

Appearance: Colorless to pale yellow clear liquid.

Almost insoluble in water, miscible with ethanol, dichloride methane or petroleum ether. It can be miscible with isopropanol in any proportion. Application:

Used as a solvent, a transdermal absorption enhancer, a lubricant and a pl...

-

Product We take your products from idea to market success

Hänseler Swiss Pharma is a dedicated partner known for its unwavering commitment to the highest quality standards and innovative strategies. We bring our enthusiasm and Swiss precision to support our partners across the entire value chain, providing custom-tailored solutions for your success in the pha...

-

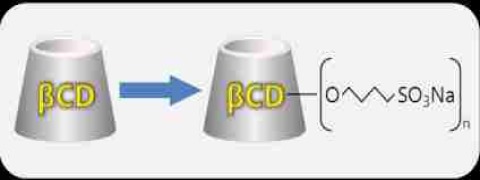

Product Cyclodextrin, CAVAMAX®, CAVASOL®

WACKER is the only company worldwide offering all three parent cyclodextrins, which are marketed under the trademark CAVAMAX®. WACKER also manufactures and offers chemically modified cyclodextrin derivatives, which are marketed under the trademark CAVASOL®. The modification of the guest with this molecular...

-

Product J.T.Baker® Viral Inactivation Solution

J.T.Baker® Viral Inactivation Solution Biotech Reagent is a highly effective, ready-to-use product, specifically developed for detergent-based viral inactivation in biopharmaceutical operations and plasma derived therapy processes. J.T.Baker® Viral Inactivation Solution is formulated with non-ionic deterge...

-

Product Macrogol 400 / Hedjuvan-MG400

Hedjuvan-MG400 is a high quality Macrogol 400. The product is produced at Kolb in Hedingen (Switzerland) and is getting tested according to the specifications of the current Ph. Eur. and USP. Kolb has a broad portfolio of non-ionic surfactants with polysorbates having a long successfull trac...

-

Product Sodium Hyaluronate - Injection grade

Hyature® is a pharmaceutical grade sodium hyaluronate which can be used as an API or excipient for drugs and medical devices in ophthalmic preparations, intra-articular injections, anti-adhesive preparations, topical preparations for wound healing and soft tissue filler, etc. Hyature® sodium hyalur...

-

Product Polygeline

Serumwerk Bernburg AG is a knowledge base regarding the production of polymer-containing sterile solutions, which can be used for a wide variety of purposes (e.g. volume replacement therapy, adjuvant in the production of vaccines). In recent years, customized formulations based on starch or gelatin have be...

-

Product Neohesperidin Dc pharma grade

Our Neohesperidin dihydrochalcone serves as an excipient, fulfilling a dual role as both a sweetener and a masking agent in oral drug delivery formulations. This additive is obtained through the hydrogenation of Neohesperidin, a flavanone naturally occurring in bitter oranges (Citrus aurantium). Its primar...

-

Product Calcium Carbonate IP BP USP EP JP Oyster Coral

We are considered in the market to be one of the leading manufacturers and suppliers of this commendable Calcium Carbonate IP BP USP EP JP and OYSTER. Processing of this product is done in accordance with the set norms and guidelines of the chemical industry, utilizing the finest ingredients and ...

-

Product Scientific Support

Selectchemie AG provides a wide range of services including scientific support. Our experienced professionals are at your service at locations in 18 countries to deliver tailor-made solutions according to your needs. Contact us for more information.

-

Product Multifunctional Excipients for the Nutraceutical and Pharmaceutical Industry

Our SYLOID® FP silica excipients are a strategic drug development tools in today’s challenging pharmaceutical industry with its demands for improved formulations, bringing new drugs to market faster, and technological advances.

SYLOID® FP silica’s unique, innovative design combine...

-

Product Excipients

Actylis, through its recent acquisitions, has become a leading global GMP excipients manufacturer to the life sciences industry, offering our customers a broad portfolio of excipients. Our excipients are currently employed in vaccines, injectables, dermal, transdermal, topical and solid dosage finishe...

-

Product AnyCoat-C® (Hypromellose); HPMC; Hydroxypropylmethylcellulose

AnyCoat-C® is a beloved brand name of the cellulose ether manufactured by LOTTE Fine Chemical.

Properties: white or yellowish white powder; soluble in mixed organic or aqueous solvent; making up transparent film when solvent remove.

Applications: Pharmaceutical excipient, food...

-

Product Trusted Ingredients for Pharmaceuticals

With Spectrum Chemical, meet the requirements specified in the USP and NF monographs, which are the official standards for all prescription and over-the-counter medicines, dietary supplements, excipients and other healthcare products.

- Ideal for parenteral, oral, topical and ophthal...

-

Product Copovidone VA64/ PVP VA64

Copovidone is a water-soluble polymer resin, white powder, odorless and tasteless, easy to absorb moisture, soluble in water, ethanol and anhydrous alcohols, with good cohesiveness, hygroscopicity, film-forming properties and surface activity.The main application is as follows,

(1)Pharmaceutical field: ...

-

Product Sunvidone ®K/Povidone K series

Huzhou sunflower pharmacetuical co. Ltd offers a wide range of products which includes povidone K series. Feature: it is an aqueous solution of synthetic polymer compound is n vinyl pyrrolidone polymers are linear. It is white to milky white amorphous powder, having a bulk density of 0.4 to 0.6; odor...

-

Product Armor Pharma Lactose Monohydrate 80M

Latest launch: ARMOR PHARMA™ lactose monohydrate 80M is a coarse free flowing powder of α-lactose monohydrate with typical Tomahawk shape.

Sieving process gives coarse particles with a narrow particle size distribution enabling very good flowability. This lactose is very often used in capsules a...

-

Product Neohesperdin DC Pharma Grade

HTBA Neohesperidin dihydrochalcone Pharma Grade is an excipient used as a sweetener as well as a masking agent for use in oral drug delivery formulations. Neohesperidin dihydrochalcone is an additive derived from the hydrogenation of Neohesperidin, a flavanone that is found in bitter oranges (Citrus aurant...

-

Product Polyglykol

Effective and high-purity ingredients including a complete range of Polyglykols (Macrogols) our universally applicable pharmaceutical polymers, with various molecular weights, supported by CEP certification and DMF type II documentation.

-

Product Expansorb

Poly(lactic acid co-glycolic acid) and poly(caprolactone) copolymers used as functional excipients for controlled and slow drug release (weeks to months) with a single injection.

-

Product Acetonitrile

A highly pure solvent used as an Excipient in Oncology Injectable formulations such as Bortezomib, Doxorubicin etc.

Specification:

USDMF

-

Product Itraconazole Pellets 22%

Cornileus pharmaceuticals (p) ltd offers a wide range of products which includes itraconazole pellets 22%. It belongs to pellets category. Contact us for more information.

-

Product CROSCARMELLOSE SODIUM

odium croscarmellose is an internally cross-linked sodium carboxymethylcellulose for use as a superdisintegrant in pharmaceutical formulations.

-

Product LIGAMED MF-2-V-MB

LIGAMED MF-2-V-MB is our most widely used excipient for the production of tablets and capsules. Its high specific surface area and fine particles offer a high releasing speed during tablet pressing and consistent physical performance of the tablets such as hardness and dissolution profiles. Due to the exce...

-

Product Excipient: Super Refined™ DEGEE

Super Refined DEGEE is ideal for use in topical and transdermal applications to enhance the permeation of poorly water-soluble API’s through various layers of the skin, thereby improving drug delivery. It can also be used as a co-solvent in self-emulsifying drug delivery systems (SEDDS), or self-microe...

-

Product PHARCOCEL - HPMC / Hypromellose / Hydroxy Propyl Methyl Cellulose

Pharmaceutical grades of HPMC will have detailed specification as per specific monograph. All our HPMC grades will be available in powder & granular form.

-

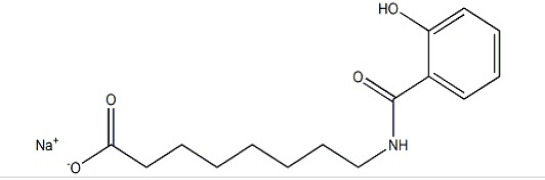

Product SNAC CAS 203787-91-1

CAS:203787-91-1

Molecular Weight:301.31337

Molecular Formula: C15H20NNaO4

Appearance: white powder

Application: medical intermediate

Delivery Time: Available goods in stock

Package: inside: douple PE bag outside: paper drum

...

-

Product APISAL (Sodium chloride API)

For the exceptionally high requirements in pharmaceutical manufacturing processes, we produce pure pharmaceutical salt exceeding the purity requirements stipulated in the pharmacopoeias. All steps of production, analysis, and quality control comply with these strict principles. APISAL® is obtained from a p...

-

Product DRCOAT - Customised Ready to use Coating Pharma Polymer

ENTERIC COATING (AQUEOUS / NON AQUEOUS)IMMIDIATE RELEASE FILM COATING / FILM COATING

MOISTUER BARRIER COATING

PEARSCENT COATING / METTALIC COATING

GLOW COATING / GLOSS COATING

TRANSPARENT COATING

-

Product PharmaSugar®

PharmaSugar® is the benchmark for formulations requiring dry or liquid sugar as an excipient.

Our products are manufactured by ISO 9001, ISO 14001, FSSC 22000 certified, GMO-free and ANSM registered sugar refineries. The batch-based management of PharmaSugar® products ensures full tr...

-

Product Stearic Acid

Stellipress Brand ensures EP/USP compliance of our high purity Micronized Stearic Acid.

Our Stearic Acid is your best choice as a Tablet Lubricant and Magnesium Stearate replacement.

-

Product Sodium Polystyrene Sulfonate USP/EP (Doshion P 504)

DOSHION P 504 is Sodium Polystyrene Sulfonate, a strong acid cation exchange resin powder. This is a pharmaceutical grade product which is used for the treatment of a specific medical condition.In certain cases there can be a build up of potassium in the bloodstream which is not removed by the kidneys...

-

Product Emulfree Duo

Emulfree® Duo is a ready-to-use system. It has been designed to stabilize the oil phase within a bi-gel, an emerging topical formulation, by ensuring fine and homogeneous dispersion in the aqueous phase. As a PEG-free excipient, it is ideal for sensitive skins and mucosea.

-

Product RESOMER® Portfolio of Parenteral Excipients

Bioresorbable polymers for controlled release depot injections & medical device applications.

The RESOMER® portfolio represents the industry’s leading selection of functional excipients for parenteral controlled release. As one of the global leaders at the market for custom and sp...

-

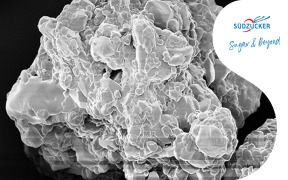

Product SÜDZUCKER COMPRI® M3000

Südzucker COMPRI® M3000 is an agglomerated, directly compressible sugar with parts of maltodextrin. It is suitable e.g. for the production of confectionery or pharmaceutical tablets.

PRODUCT BENEFITS

· Di...

-

Product Excipia Experts in excipient analysis, characterization and deformulation / reverse engineering

Excipients can have an important impact on the manufacturability and pharmaceutical performance of a formulation. It’s therefore important to identify and control functionality related characteristics (FRCs) of excipient materials in order to achieve safe, robust and stable products. Expe...

-

Product Solarus Titration Unit by HIRSCHMANN

A titration unit with a reagent recirculation system for manual titration directly from the reagent bottle. Power supplied by a solar cell.Available in three volumes (10 ml, 20 ml and 50 ml).

Advanced energy concept, precision results - sets standards as the world's first digital burette with inte...

-

Product Manufacturing

Custom API Manufacturing, Fermentation, Finished Dosage Form, High Potency, Lipid Nanoparticle, Rare / Orphan, Stability & Release Testing, Sterile Fill Finish, APIs & Intermediates, Fine Chemicals

-

Product Formulation Development

Our Formulation Scientists and Process Engineers are experts in poorly soluble compounds and high containment operations. Our formulation development lab and pilot plant suites are specifically designed for high containment and outfitted with cGMP matching technologies. We follow a data driven approach to ...

-

Product SACCHARIN (E-954)

Saccharin´s sole European producer: Productos Aditivos.

We supply our Saccharin mainly as excipient to the pharmaceutical industry and as additive to the food industry. We have a unique position in this market: based on our quality, reliability and ...

-

Product BonuPrint® - Printing Ink

BIOGRUND provides a wide range of coloring products which includes BonuPrint®. It's a printing color ink. The fine, homogeneous, liquid pigment dispersion for solid oral dosage forms, available as an organic or aqueous solution. For printing logos, brand names or barcodes onto the tablet. It increas...

-

Product Sodium Hydroxide Pellets (Eka Pellets™)

Your benefits

- Expertise in alkali production since 1904

- produced in Sweden in accordance to IPEC-GMP

- fine and laboratory chemicals (synthesis and analysis) &...

-

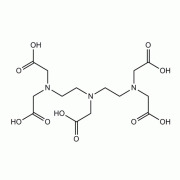

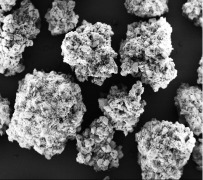

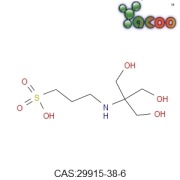

Product BETADEX SULFOBUTYL ETHER SODIUM

Betadex Sulfobutyl Ether Sodium is a kind of high water-soluble anionic cyclodextrin derivative. It can easily form non-covalent inclusion complexes with drug molecules. As a result,excllent performance can be available in many aspects. It helps enhance drug stability, solubility and safety, reduce dr...

-

Product TABLUBE - MAGNESIUM STEARATE

Nitika Pharmaceutical Specialities Pvt Ltd provides wide range of excipients which includes Tablube - Magnesium Stearate. It's a type of lubricants and glidants.

Product Description:

· DMF Available

· &nbs...

-

Product Montanox™

The MONTANOX™ range is composed of different grades of polysorbates that can be used to solubilize active pharmaceutical and/or biological ingredients and to formulate oil-in-water emulsions for oral, topical and injectable products.

• MONTANOX™20 PHA PREMIUM: Polysorbate 20 • MONTANOX™60 PHA PREMIU...-comp244983.png)

-

Product Contaminants

Neotron Pharma, thanks to its many years of experience in the Food department, is able to quantify the presence of contaminants such as Pesticides, Aflatoxins, Mycotoxins under GMP regime. This type of analysis can be fundamental for all those suppliers of raw materials and Erbal intended for the supplemen...

-

Product NUTRINOVA® Sorbates

Nutrinova® Sorbic Acid and Nutrinova® Potassium Sorbate are preservatives produced in Germany that can extend the shelf- life of pharmaceutical products by slowing the growth of microorganisms. Our high ...

-

Product galenIQ™ 720

BENEO-Palatinit GmbH provides the pharmaceutical excipient galenIQ™ 720. It is an agglomerated spherical isomalt for direct compression and powder applications. General benefits: high agglomerate stability and excellent flow; morphology ensures homogeneity of the mix and content uniformity; very low compre...

-

Product Purolite C115KMR Polacrilin Potassium

Polacrilin Potassium, excipient used as tablet disintegrant.

-

Product POVIDONE, MICROCRYSTALLINE CELLULOSE, HYPROMELLOSE, CROSPOVIDONE, COPOVIDONE, CCS, COLLOIDAL MCC, LACTOSE, STARCH, SUCRALOSE, SACCHARIN, CYCLODEXTRINS, POLOXAMER, POLYSORBATE, PEG, API, INTERMEDIATES, FILTER BAGS, SILICA, SILICONES,

DILUENTS, BINDERS, DISINTEGRANTS, FILM FORMERS, PLASTICIZER, POLYMERS, SWEETENERS, SURFACTANTS, PEPTIDES, OMEGA 3 FATTY ACID, VITAMINS, DIETARY FIBRES, COCOA POWDER, ANTI AGEING, ANTI WRINKLES, MOISTURIZERS, ENCAPSULATED BEADS, SCRUBING BEADS,

-

Product TRIS

English Name:Tromethamine

Molecular Formula:C4H11NO3

Molecular Wt:121.14

CAS:77-86-1

Assay : ≥99.5%

Appearance : White crystalline powder

TRIS is an important pharmaceutical intermediate that can be used to synthesize dexketoprofen tromethamine and ...

-

Product Dexolve

Dexolve is the first generic USP and EP-conform Betadex Sulfobutyl Ether Sodium for:• solubility enhancement (10 to 100,000 fold) • Improvement of chemical stability • Increased bioavailability, facilitated delivery • Reduced aggregation • Moderate irritationor reduced side-effects • Maximiz...

-

Product Zinc Oxide IP/BP/USP

Neelkanth Minechem Zinc Oxide IP | BP | USP is a topical skin product that is used as a protective coating for mild skin irritations and abrasions.

-

Product Microcrystalline Cellulose IP/BP/Ph.Eur./EP/USP/NF/JP/IHS

Ankit Pulps & Boards Pvt Ltd offers a wide range of products which includes Microcrystalline cellulose IP/BP/Ph.Eur./EP/USP/NF/JP/IHS. Feature: It has high binding capability and creates tablets that are extremely hard & stable, yet disintegrate rapidly. Contact us for more information.

-

Product Compritol® 888 ATO

A glyceride with a high melting point used as a modified release agent or lubricant in tablets. Can also be used in lipid coating technologies and as lipid carrier for nanoparticles. UNII Code (FDA): R8WTH25YS2

Preferred Substance Name (FDA): GLYCERYL DIBEHENATE

Handbook of Pharmac...

-

Product SORBITOL 70% SOLUTION

Sorbitol 70% (D-Glucitol) SolutionGulshan Polyols, is one of the largest manufacturers of Sorbitol (D-Glucitol) with a capacity of 72000 MTPA in India. GPL's Sorbitol 70% (D-Glucitol) solution facility is an ISO 9001:2008, HACCP, OU-Kosher, HALAL & FSSAI certified company. It also meets&...

-

Product Citric Acid

Citric Acid

1..Standards:Current Standards of BP,USP,EP,FCC;

2. Well sourced from well-known producing bases in China; quality could be ensured and prices are competitive with considerable supply availability

3.Good after-sale service

-

Product Pharmaceutical Grade Pvp

Jiaozuo zhongwei special products pharmaceutical co. Ltd offers a wide range of product which includes pharmaceutical grade pvp. Properties: it is white or creamy white powder or flakes,ranging from low to high viscosity & low to high molecular weight,which characterized by k value. It’s easily soluble...

-

Product EvaPol - Methacrylic Acid Polymer

EvaPol range of products are derived from cross linked polyacrylic, styrene, Methacrylic Acid Polymer used in Pharmaceutical Industry for different applications. Taste Masking of Bitter Drugs

Odour Masking of Bitter Drugs

Tablet Disintegration

Sustain Release and Control Release of AP...

-

Product Calcium Excipients and Actives

Sudeep Pharma Offers Multiple Different Variant of Calcium Salts used as Excipients and Actives Largely in the Pharmaceutical and Nutraceutical Industry.

Dicalcium Phosphate - Anhydrous Dicalcium Phosphate - Dihydrate

Tricalcium Phosphate

Calcium Carbonate DC Grade

Calc...

-

Product Excipient grade

Pharma Excipients:

The globalisation of the pharmaceutical industry combined with a global regulatory has created a need for a comprehensive excipient quality and control standard. Our FDA approved manufacturing facility with IOS 9001:2015 to produce high quality pharmaceutical excipients...

-

Product POVIDONE K60

◆ Cosmetics IndustryPVP K60 Powder can be utilized as a film-forming agent, viscosity-enhancement agent, lubricant, and adhesive for hair sprays, mousses, gels, and lotions.

◆ Pharma IndustryPVP K60 Powder can be used as a binder for tablets, a dissolving assistant for injections, a fl...

-

Product Ethanol 96

Kimia offers a wide range of products which includes ethanol 96. Uses and applications: it is used in the manufacture of pharmaceutical products. Ethanol 96 can be supplied as either synthetic or fermentation ethanol. Contact us for more information.

-

Product Lactose

A kind of widely-used pharmaceutical excipient, including the following types:1. Lactose monohydrate

2. Spray-dried lactose

3. Anhydrous lactose

4. Granulated lactose

5. Inhalation lactose

6. Co-processed lactose

-

Product New Inert starter beads CELLETS® 150 by ingredientpharm

We introduce CELLETS® 150, a new particle size for our pharmaceutical MCC spheres, ranging from 150-300 µm. State-of-the-art formulations with modified release profiles are often based on API carriers such as MCC pellets. CELLETS® are 100% MCC starter beads, offering unbeaten stability, sphericity, and sur...

-

Product Salcaprozate Sodium(SNAC)

Zhejiang hisoar pharmaceutical offers a wide range of products which includes Salcaprozate Sodium(SNAC) . Contact us for more information.

-

Product Carbomer

CarboClear is a range of high-quality, benzene-free carbomers that are ideal for use in a wide range of personal care and pharmaceutical products. These are high molecular weight, water-soluble polymers that can be used as rheology modifiers to improve the texture, performance and stability of products. qq...

-

Product GKF 60

Our R&D capsule filling machine takes your molecule to production. The GKF 60 capsule filling machine offers high versatility and state-of-the-art quality control features for early R&D stages. The platform can accommodate both established and new dosing technologies and provides...

-

Product Organic & Inorganic Bromide

Organic & Inorganic Bromide like Ammonium Bromide, Hydrobromic Acid 48%, Lead (II) Bromide Anhydrous, Manganese (II) Bromide Tetrahydrate, Nickel (II) Bromide Anhydrous, Potassium Bromide, Strontium Bromide Anhydrous, Strontium Bromide Hexahydrate, Magnesium Bromide Hexahydrate, Antimony (III) Bromide,...

-

Product Topical Excipients

Biesterfeld Spezialchemie GmbH offers a wide range of pharmaceutical excipients for topical formulations in various forms. For example silicone fluids & volatiles, cyclics, silicone blends, zinc oxide, glycerin, carmellose sodium, stearates, parabens etc.

-

Product DiCOM - DC

DiCOM - DC - For small dose API and large dose API with good compressibility DiCOM - DC PL - For small dose API and large dose API with good compressibility

DiCOM - DC DT - For low disintegration time formulations

DiCOM - DC SP - For li...

-

Product Sugar Sphere , Tartaric acid Pellets, MCC Pellets, Sugar globules, Mannitol Sphere

We manufacture excipients also Know as Starter Pellets/ Neutral Pellets they are white or off white in a color spherical shaped pellets. Available in all sizes. 150 to 2000microns, ASTM 10-100#.

Low Friability and Excellent Crushing Strength Hence can withstand the mechanical stress for...

-

Product Ascorbic Acid(Vitamin C)

(5R)-5-[(1S)-1,2-Dihydroxyethyl]-3,4-dihydroxyfuran-2(5H)-one.white or almost white, crystalline powder orcolourless crystals, becoming discoloured on exposure to airand moisture. Freely soluble in water, sparingly soluble in ethanol(96 per cent).

-

Product Aduxol OP-010/ E

Octoxinol 10 is used as a detergent in biochemistry. Not

denaturizing proteins, it is used in protein purification to

solubilize membrane proteins in their native conformation

from membranes. It is also used for viral inactivation

of enveloped viruses by the solvent detergent method. qq...

-

Product LACTOSE ANHYDROUS

Anhydrous lactose is a versatile raw material that can be used as an excipient in tablet and capsule formulations, as a carrier in dry powder inhalers, and as a lyophilization agent in parenteral (biotechnology-type) productions.

-

Product CROSPOVIDONE TYPE A & CROSPOVIDONE TYPE B

Crospovidone is a white to creamy-white, finely divided, free flowing, practically tasteless, odourless or nearly odorless, hygroscopic powder.

-

Product Excipients for Gel Capsules

Enhance your oral formulations with high quality ingredients. Contact us to learn about the excipients in development.

-

Product Benecel™ HPMC DC

benecel™ hypromellose (hydroxypropyl-methylcellulose or HPMC) is a versatile excipient with a variety of applications. HPMC is the most widely used polymer in hydrophilic matrix systems with widespread use in controlled-release dosage forms.

benecel™ DC HPMC is a surface modified, co-proce...

-

Product Magnesium Oxide

Magnesium oxide (MgO) is a white solid at room temperature and exists in nature as periclase. It can be produced by calcining basic magnesium carbonate or magnesium hydroxide, or using carbon dioxide as an oxidant. Magnesium oxide is slightly soluble in water and soluble in acid. It has a wide range of app...

-

Product Liquid Flavours

Liquid flavours for formulation ranging from sweet orange to bittermask flavours.

-

Product ETHOCELâ„¢ Premium Ethylcellulose Resins

An excellent choice for modified release

ETHOCELâ„¢ premium ethylcellulose resins are water-insoluble polymers. They are soluble in a wide range of organic solvents, beginning with aliphatic alcohols such as ethanol and isopropanol, and are compatible with most other familiar organic solvent chemi...

-

Product Microcrystalline cellulose CEOLUS™ KG

CEOLUS™ KG Grades is highly compactible MCC with fibrous particles. Enable poorly compactible and/or high dose formulations. Solve tableting issue such as insufficient hardness, sticking or capping. Also enable unique and patient friendly dosage form like MUPS, ODT, multiple-layers, multiple APIs combinati...

-

Product ASHACEL ETHYLCELLULOSE

ASHACEL ETHYLCELLULOSE EXCIPIENT USED FOR CONTROLLED RELEASE, MOISTURE BARRIER AND TASTE MASKING PURPOSES IN PHARMACEUTICALS. ASHA ALSO OFFERS TECHNICAL SUPPORT TO ITS CLIENTS WHEN IT COMES TO USE OF ITS PRODUCTS IN THEIR FORMULATIONS.

-

Product DICALCIUM PHOSPHATE DIHYDRATE POWDER/DC GRADE

DICALCIUM PHOSPHATE IS EXCELLENT FILLER. IT IMPROVES THE FLOWABILITY OF THE API. DC GRADE IS KNOWN TO REDUCE MANY STEPS IN TABLET FORMATION AND THUS REDUCE OVERALL COST.

-

Product UNIGEL 500

UNIGEL 500 IS A FOOD GRADE PREGELATINIZED STARCH PRODUCED FROM CORN UNDER SPECIFIC PROCESS AND CONDITIONS AND PARAMETERS HICH COMPLY GMP AND FDA PRODUCT STANDARDS.

-

Product Betadex Sulfobutylether Sodium (Sulfobutylether Betacyclodextrin)

Betadex Sulfobutylether Sodium is a solubiliser used in injections such as Remdesivir,, Voriconazole etc.

-

Product Trehalose SG

Trehalose is a dihydrous and non-reducing disaccharide consisting of two glucose molecules linked by an a, a-1, 1 bond. Our TREHALOSE SG is monographed as being low endotoxin and intended mainly for injection. Its remarkable stability makes this sugar an ideal excipient as a stabilizer ...

-

Product Chenodeoxycholic Acid Sodium Salt

ICE S.p.A provides a wide range of products which includes chenodeoxycholic acid sodium salt. It has been the same pharmacological properties of chenodeoxycholic acid. It reduces cholesterol amount, probably by inhibiting liver synthesis, allowing gallstones dissolution. Packaging: lab or pilot scale scale...

-

Product L-Cysteamine HCl (2-MEA)

L-Cysteamine HCl, a.k.a. 2MEA, has been manufactured for use as a critical process chemical for downstream biological drug manufacturing. L-Cysteamine HCl has been manufactured and purified under strict ICH-Q7 guidelines for excipient materials and can be considered an excipient grade product.

-

Product Sodium Succinate anhydrous

Dr. Paul Lohmann® offers a wide range of high-quality Mineral Salts suitable for the final vaccine formulation. Since Mineral Salts stabilize biologics and vaccines during processing, storage and application, they are an essential part of the entire biomanufacturing process. Please contact us f... -

Product Excipients

We pride ourselves on a customer-centric approach, realizing that each customer has unique needs requiring customized solutions. Our team of dedicated Industry, Product and Technical Specialists have the experience and knowledge to help you develop solutions and reduce your costs of operation...

-

Product Acrycoat® Methacrylic Acid Copolymer

Acrycoat® family of polymers are Methacrylic acid copolymers type A, B & C which confirms to USP/NF, EP and JP specification.

Immediate Release: The Immediate release series work in wide application range which includes tablet binding, taste masking, odor masking and provi...

-

Product AceCel®- Excipient to Ace your Productivity!

AceCel® is a bulk dried Microcrystalline Cellulose (MCC) manufactured by Sigachi®, industry leader for over three decades and known for it’s excellent and consistent quality. AceCel® is widely used in pharmaceutical, nutraceutical and food applications as a binder/filler/...

-

Product Beta Arbutin

Sinoway industrial co., ltd offers a wide range of products which includes Beta Arbutin. It belongs to excipients category. Contact us for more information. -

Product Pharmaceutical formulation

Artesan Pharma GmbH & Co. KG has the edge for sophisticated reformulation of recipes as well as optimisation of products already established in the market. Pharmaceutical Formulation department focuses on medicinal products, food additives, medicinal devices and cosmetics. Opportunities: Double-layer table...

-

Product DISOLCEL® Croscarmellose Sodium

DISOLCEL® Croscarmellose Sodium is an internally cross-linked carboxymethylcellulose sodium. Cross-linking was achieved without the use of cross-linking agents. Compared to the soluble carboxymethylcellulose sodium, cross-linked DISOLCEL® is essentially water-insoluble, yet swelling and absorbing many time...

-

Product Lactose for inhalation

Imcd india pvt. Ltd. provides a wide range of products which includes lactose for inhalation. It is manufactured to strict regulation for pulmonary drug delivery. Lactose, a carrier in dry powder inhalations (dpi), provides good flowability enabling device to be filled and assist with deagglomeration of co...

-

Product Ampicillins & Combinations entire range

Generex Pharmassist Pvt. Ltd provides wide range of formulations which includes ampicillins & combinations entire range. Therapeutics: anti infectives. Category: penicillins. Dosage form: tablets, disp tabs, capsules, dry syrups & injectables. Contact us for more information.

-

Product (1) PROTECTAB HP-1 , (2)PROTECTAB MB-1, (3) PROTECTAB ENTERIC M-1, (4)PROTECTAB HP-2, (5) PROTECTAB HP-2 TRANSPARENT, (6) PROTECTAB HP-2 PEARL FINISH, (7)PROTECTAB EC-1, (8)PROTECTAB OM-1, (9) HYPRO SR-1 (10) ENHANCE DT

1. PROTECTAB HP1 (HPMC based, Organic/Aqueous Film Coating Material) 2. PROTECTAB MB-1 (Moisture Barrier Film coating material)

3. PROTECTAB ENTERIC M1 (Methacrylic Acid Copolymer based Enteric Coating material),

4.PROTECTAB HP-2(High Film strength HPMC based Film Coating Material),

5. PROTEC...

-

Product Talcum Powder IP/BP/USP

Talc is a clay mineral composed of hydrate magnesium silicate with the chemical formula mg3si4o10(oh)2. talc in powder form,often in combination with corn starch.

-

Product PINE OILS & ITS DERIVATIVES

AOS Products Pvt Ltd offers Pharmaceutical Grade Pine Oil, Terpeniol, Turpentine Oil and Terpin Hydrate. The products offered are of high quality and can be used in Pharma, Food, cosmetics and other commercial uses.

Pine Oil and its Derivatives:We are engaged in manufacturing a wide range of pin...

-

Product WINCOAT WT-MPAQ Moisture Protective Aqueous film coating

Wincoat Colours & Coatings Pvt.Ltd. offers wide range of functional film coating products which includes wincoat wt – mp – moisture protective film coating. It is recommended for hygroscopic products which are sensitive to moisture. It is one step coating system gives high level of moisture protection ...

-

Product Dried Aluminum Hydroxide Gel

Light and heavy powder for excipient manufactured under GMP system. Granule type is available.

-

Product YTZ Grinding media

Grinding Media for wet milling process , compatible with pharmaceutical applications for API particle size reduction to nano scale. YTZ® is recognized by users as the best available product for grinding process, providing highest quality results for employed processes. Complete traceability from... -

Product Magnesium Sulfate-7-Hydrate

CFL-Chemische Fabrik Lehrte GmbH provides wide range of products which includes magnesium sulfate-7-hydrate. Contact us for more information.

-

Product Aerosil

Andenex-Chemie Engelhard + Partner GmbH offers a wide range of products which includes aerosil. It belongs to excipients category. Contact us for more information.

-

Product Excipients

Carbomers, Castor Oil Derivates, Acrylate Copolymer, Calcium Carbonate, Carboxymethylcelullose, Crosspovidone, Calcium Phosphate, Ethylcellulose, Hydroxypropylmethylcellulose HPMC, Lactose Monohydrate, Magnesium Stearate, Maltose, Microcrystalline...

-

Product Conical filter

Qosina offers wide range of filters which includes conical filter. Contact us for more information.

-

Product Compound Mifepristone Tablets

Hubei gedian humanwell offers a wide range of products which includes compound mifepristone tablets. It belongs to formulation category. Indications: sequentially combined with misoprostol tablets,it is indicated for the medical termination of intrauterine pregnancy within 49 days’ menolipsis. Packagi...

-

Product Sodium Starch Glycolate (USDMF)

USP/NF/BP/EP/JP/CP/IP Available in low solvent grade and standard grade. GMP certificate available

-

Product Alendronate Sodium

OmniCap GmbH offers a wide range of products which includes Alendronate Sodium. Contact us for more information.

-

Product Liquid Paraffin

Synonyms: White Mineral Oil, Liquid Vaseline, Paraffin Oil, White Oil

Grades, CX, PX and LX (Light and Heavy)

INTRODUCTION:

· Our entire range of Mineral Oil are purified mixture o...

-

Product Tableting Aids

Nordmann, Rassmann GmbH - The NRC Group offers a wide range of products which includes tableting aids. Features: it is used for the production of tablets with following functions control of drug release and stability improvement. Contact us for more information.

-

Product Coptis Bolus

Jingxin Pharmaceutical offers a wide range of finished products which includes coptis bolus. It belongs to herbal drugs. It is for clearing the upper heat category. Contact us for more information.

-

Product Acrylic Acid Polymer

Arihant Innochem Pvt Ltd offers a wide range of Pharmaceutical Excipients which includes Acrylic acid polymer. Contact us for more information.

-

Product Glycine

This amico acid can be used as a starting material, feed additive, food additive, cosmetical ingredient, excipient or API.

-

Product Excipient

Dksh india pvt. Ltd offers a wide range of ingredients which includes excipient. Contact us for more information.

-

Product Dicalcium phosphate

Cosmos international offers a wide range of pharmaceutical products which includes Dicalcium phosphate. It belongs to excipients category. Contact us for more information.

-

Product Bronopol

Farmachem life pvt ltd offers a wide range of excepients products which includes bronopol. Contact us for more information.

-

Product Cefexime 50MG (DISPERSIBLE TABLET)

Skymap pharmaceuticals pvt. Ltd offers a wide range of products which includes cefexime 50mg (dispersible tablet). It belongs to tablet category. Contact us for more information.

-

Product (1R,2R)-1,2-Cyclohexanedimethanol

Yasham speciality ingredients private limited provide a wide range of excipients products which includes (1r,2r)-1,2-cyclohexanedimethanol. Contact us for more information.

-

Product Cisplatin

NORTHEAST PHARMACEUTICAL GROUP CO.,LTD. provides wide range of products which includes cisplatin. It belongs to anti cancer series category. Contact us for more information.

-

Product Heparin Sodium

Hubei Enoray Biopharmaceutical Co Ltd provides wide range of products which includes heparin sodium. Contact us for more information.

-

Product Amodiaquine 200mg (3 tabs) + sulfadoxine 500mg / pyrimethamine 25mg (1 tabs)

Eskay fine chemicals manufactures bulk drugs, chemicals and pharmaceutical formulations which includes amodiaquine 200mg (3 tabs) + sulfadoxine 500mg / pyrimethamine 25mg (1 tabs). It belongs to anti malarial formulation category. Packaging: 100 x 4 (3+ 1) tablets. Contact us for more information.

-

Product Anastrozole tablets usp

Flagship Biotech International Pvt. Ltd offers wide range of oncology products which includes anastrozole tablets usp. Contact us for more information.

-

Product Preformulation development

Aizant drug research solutions pvt ltd is an integrated drug development solutions provider which includes preformulation development. It belongs to dosage from development category. It includes polymorph screening and selection, salt form selection, crystalline properties, ph solubility and stability, dyn...

-

Product Nurofentabs

Ethypharm offers pharmaceutical products which includes nurofentabs. Contact us for more information.

-

Product Diclazuril

Zhejiang Guobang Pharmaceutical Co Ltd offers a wide range of products which includes Diclazuril. It belongs to feed additive category. Contact us for more information.

-

Product Dexketoprofen Thiocolchicoside

Guangzhou Bairui Medicine Co Ltd provides wide range of products which includes dexketoprofen thiocolchicoside. It belongs to formulations category. Contact us for more information.

-

Product Amlodipine besylate Film-coated tablet

HEC Pharm Group provides wide range of products which includes amlodipine besylate film-coated tablet. It belongs to formulation category. Contact us for more information.

-

Product Azithromycin 40%Taste-Mask Pellet

Starway Pharm Co. Ltd provides wide range of semi-formulations & fdf which includes azithromycin 40%taste-mask pellet. It belongs to human api category. Contact us for more information.

-

Product Fatty acid esters

As-tec chemicals ltd offers a wide range of products which includes fatty acid esters. It belongs to excipients and drug category. contact us for more information.

-

Product (Qing Chi Ling) lecithin tablets

Gansu dadeli pharmaceutical co., ltd offers a wide range of products which includes (Qing Chi Ling) lecithin tablets. It belongs to prescription drugs - non-antibiotic - Tablets category. It is is extracted from natural egg yolk, so far not found any reports of adverse reactions and side effects.. Package:...

-

Product Ivermectin drench

Hebei veyong animal pharmaceutical co. offers a wide range of products which includes Ivermectin drench . It belongs to solution for oral category. Content: 100ml, 250ml.500ml, 1000ml. Diversified specification and package are available on the basis of clients needs. Contact us for more information.

-

Product Excepients

Vitalchemie provides a wide range of pharmaceutical products and services which includes excepients. Contact us for more information.

-

Product Croscarmellose Sodium EP

VASA PHARMACHEM PVT LTD provides wide range of products which includes croscarmellose sodium ep. It belongs to excipient category. Contact us for more information.

-

Product Irbesartan&hydrochlorothiazide tablets

Zhejiang Huahai Pharmaceuticals offers a wide range of products which includes Irbesartan&Hydrochlorothiazide Tablets. It belongs to formulation category. Contact us for more information.

-

Product Espheres ES

Ideal cures has a wide range of products which includes espheres ES.It contains not more than 92% of sucrose, calculated on the dried basis. Composition: sugar (62.5% to 91.5%), maize starch (8.5% to 37.5%). It is used as cores for pharmaceutical pellet formulations. Contact us for more information.

-

Product Tretinoin cream

Chongqing Huapont Pharmaceutical Co., Ltd provides wide range of formulations which includes tretinoin cream. Packaging: 15g, 30g. Contact us for more information.

Excipients

From coating and binding agents to ointment bases, antioxidants and more, search a wide range of excipients from hundreds of international suppliers online at CPhI Online.

The word excipient, derived from the Latin phrase excipere - to receive, to except, or take out, refers to any component other than the active pharmaceutical ingredient contained in solid dosage forms or used to manufacture a finished pharmaceutical product (FPP). Excipients play a significant role in the formulation and administration of dosage forms and the drug development process. They affect the aesthetics, processing capability, bioavailability, and performance of the drug substance and the compliance of patients using a specific dosage form.

Excipients can either act as carriers (basis or vehicles) or diluents, etc., of the active ingredients or components. They aid in the drug product manufacturing process and also enhance the bioavailability, stability, appearance, storage integrity, effectiveness, safety, and delivery of the drug product during use.

Excipients and active ingredients form the major components of drugs. However, excipients make up the bulk of drugs and medicines, making about 90% of each drug’s composition. These substances are mostly pharmacologically inactive or inert and serve specific purposes. However, as opposed to popular assumptions, excipients are not always inactive or inert and may result in side effects or adverse reactions if misused.

The wrong choice, quality, combination, or amounts of excipients used can have devastating effects on the patient’s health. Like every other drug component, these inactive ingredients need to be standardized, regulated, and validated to ensure the safety of the chemical decomposition products for consumption.

Pharmaceutical products contain not just active ingredients but also other components that largely influence the drug’s pharmacokinetics and pharmacodynamics.

There are a variety of excipients contained in FPP dosage form. The type of excipient included in each FPP is determined by the active ingredient contained, route of administration, and intended dosage form. For example, a tablet formulation is an oral dosage form and usually contains binders, fillers, diluents, disintegrators, and lubricants.

How many excipients are used in the pharmaceutical industry?

In almost every drug form, there is an excipient or combination of excipients and there are over 1,000 excipients used to manufacture finished pharmaceutical products.

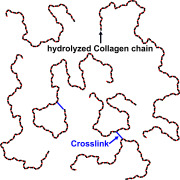

Initially, excipients consisted of biologically inert, structurally simple, and naturally derived substances such as minerals, wheat, sugar, etc. Nevertheless, in recent times, the production of novel drug formation systems has led to several new and novel excipients such as coprocessed excipients.

How are pharmaceutical excipients classified?

Excipients are classified based on their route of administration (oral, parenteral, and topical excipients, etc.), on origin (Organic and inorganic chemicals), and by functionality (Fillers, emulsifying agents, excipients for direct compression, etc.). These classifications have subdivisions.

The oral dosage forms make up most dosage forms administered to patients due to their formulation, ease of formulation, administration, and transport, among many others. Given this, the main excipients are found in solid dosage formulations and serve as high revenue drivers in the pharmaceutical excipient market. Some main excipients include calcium phosphate, dicalcium phosphate, starch, magnesium stearate, gelatin, and several others.

Role of excipients in drug formation

The traditional use of excipients has been modified by the development of novel drug delivery systems. Beyond increasing the bulk of formulation and simplifying the manufacturing process, excipients perform a variety of roles such as binding ingredients, boosting patient’s acceptance and compliance (by masking unpleasant odors or tastes), enhancing the stability of active ingredients, extending viability and acting as diluents (for example, microcrystalline cellulose, starch), etc.

How do excipients affect the performance of drug products?

The bioavailability of drugs refers to the amount of and rate at which a drug’s active ingredient is being made available at its active site. Although excipients are generally pharmacologically inert or inactive, they can interact with drugs in various dosage forms and influence physiologic factors during absorption, distribution, and elimination.

Excipients that affect the bioavailability of drug formulations are capable of influencing their overall performance, either in a positive way by improving performance and therapeutic effect, or in a negative way by diminishing them. The extent of the impact is dependent on the dose and potency of the formulation, site of absorption, therapeutic window, or rate-limiting factors of drug absorption, and many other factors.

Excipients can result in pharmacokinetic interactions through modulation of intercellular tight junctions, metabolic enzymes, and transporter proteins. The bioavailability of drugs can be affected by excipients’ solubility at absorption sites, liability to enzymatic interaction and degradation, drug-excipient interactions, etc.

Poorly water-soluble drug formulations will result in low and erratic bioavailability. However, lipid-based, surfactant-based, and polymeric excipients have high solubility rates and can improve bioavailability.

Ionizable and soluble excipients can exhibit charge interactions with APIs. For example, positively charged drugs such as polymycin and neomycin can form precipitations in the presence of sodium alginate.

Excipients can also affect the dissolution kinetics of drugs by altering the medium in which the drug dissolves or reacting with the drug. Suspending agents help increase the viscosity of the drug vehicle, which, in turn, reduces the dissolution rate from suspensions. For example, an excessive amount of magnesium stearate in tablet formulations can repel water, and limit the rate of drug dissolution, thereby decreasing the rate of drug absorption and the bioavailability of the drug. Formulation processes such as wet granulation, also have a huge effect on the bioavailability of drugs.

Best practices in dealing with novel excipients

Novel excipients are simply excipients used in drug formulations or through a route of administration for the first time. These excipients could be new chemical products or a previously used and certified excipient that hasn’t been established for use by humans or through a specific administration route.

For example, new solubilizers are required to solve the drug delivery challenges associated with poorly water-soluble drugs. New and novel excipients usually include natural polymer excipients, synthetic polymers, natural polymers modified with/by synthetic polymers, coprocessed excipients, and synthetic polymers modified by other combinations or smaller molecules. Some examples of novel excipients include albumin, Soluplus, Kollicoat Smartseal 3D, etc.

Novel excipients play an essential role in producing and introducing new, advanced, and safer drugs to the pharmaceutical market. However, due to global regulatory policies, there have been various challenges to the development of new excipients. Regardless of this, more companies are adopting innovative excipients to develop novel drug formulations. This has given way for more recent and advanced drug delivery systems to provide safer and more effective drugs for patients and more convenient administration routes. The concept of novel excipients has further broadened the scope of pharmaceutical science.

What drug development challenges do drug sponsors encounter during the manufacturing process that could be addressed by using novel excipients?

With new and significant innovations in the pharmaceutical industry, such as the development of novel drugs for the treatment of rare and orphan diseases, the need for new and advanced excipients to boost drug delivery systems is on the rise. As drug products evolve and increase in structural complexity, the formulation challenges also increase. The use of novel excipients significantly impacts the drug development process, creating various treatment types available to patients, and introducing new therapies into the pharma market.

The development and evaluation of NCEs are costly to process compared to the process of modification of previously established excipients. This issue can be addressed by the development of multi-functional novel excipients, which can perform several roles such as boosting drug stability and bioavailability, controlling API release based on therapeutic needs, etc. These excipients’ production results in a significant decrease in manufacturing cost, hastens the drug development process and improves drug sales and company growth.

Other challenges encountered by sponsors include the need for solubility, stability and permeability modulation, loss of compaction due to wet granulations and high-moisture compatibility of drugs, and increased demands for ideal filler-binders for direct compression, among others.

What are the latest guidelines for novel excipients?

Currently, novel excipients are not evaluated and regulated independently. However, they can be submitted, evaluated, and regulated as part of an IND or IMPD. There are no clear-cut or approved regulatory pathways provided by the FDA or the European Medicines Agency (EMA) to independently assess the efficacy and safety of novel excipients. This present a major barrier and set-back to the pharmaceutical excipient industry and global market, limiting innovation of new and novel excipients regardless of whether they are modifications of existing chemical entities or new chemical entities (NCE).

Although the International Pharmaceutical Excipients Council has been advocating since 2011 for the implementation of a novel excipient approval process by the FDA, the evaluation process hasn’t been put in place. Implementing a novel excipient review or evaluation program will significantly drive the pharmaceutical industry and give room for innovative drug formulations.

Top trends in pharmaceutical excipients

The pharmaceutical excipient industry is rapidly evolving and is continuously searching for new ways to provide innovative and advanced drug formulations for therapeutic purposes. According to a recent study, the global pharmaceutical excipient market is anticipated to experience massive growth over the 2019-2025 forecast period. The market size is expected to reach an estimated value of USD 9.7 billion, at a steady CAGR of 5.8%.

The pharmaceutical excipient markets’ top trends include the increased use of nanotechnology, patent expiries, increased demand for multi-functional excipients, a competitive market landscape, the binders segment taking the lead as the fastest-growing market, and North America possessing the largest share in the global market. The pace of the global pharmaceutical excipient market growth serves as a pharma trend barometer.

Who are the top players in the pharmaceutical excipients industry?

Due to the increasing need for pharmaceutical excipients and the exponential growth of the global pharmaceutical excipient market, there has been a rising competition between excipient manufacturer and excipient supplier in this industry. Amongst the competitor is top players that have largely contributed to the growth of the pharmaceutical excipient industry.

Some of the top players in the pharmaceutical excipient industry include BASF SE, Evonik Industries AG, Lubrizol Corporation, Croda International Plc., Ashland Inc., Avantor Performance Materials Inc., The Dow Chemical Company, Innophos Holdings Inc., Archer Daniels Midland Company, Colorcon Inc., Kerry Group, Merck, Signet, and FMC Corporation amongst many others. The collaborative efforts, expansions, and agreements of these excipient manufacturers to boost the growth of the market.

What is the revenue, sales, and price analysis of top manufacturers of pharmaceutical excipients?

The binder’s segment is anticipated to dominate the pharmaceutical excipient market during the forecast period. In 2017, the pharmaceutical excipients market achieved a total revenue of about USD 4256.3 million, and this revenue is anticipated to grow at a rate of about 6% until 2023. The growing income levels, increasing health expenditures, and improved health awareness globally reflect the many potentials of pharmaceutical excipients.

In addition, the organic segment of the excipient market, including carbohydrates, proteins, petrochemicals, and others, is likely to contribute to the growth of the pharmaceutical excipients market. The rising demand for and application of organic excipients in pharmaceutical industries is expected to drive sales and market growth. Given this, the organic chemicals market share segment is anticipated to grow faster than the inorganic market segment. This benefits the manufacturers and the patients alike.

It is expected that top pharmaceutical excipients manufacturers in North America will record a spike in revenue generation during the forecast period. It would be influenced by the development of advanced infrastructures as well as better investment policies. Several pharmaceutical excipient manufacturing companies in this region participate in projects contributing to the growing demand for novel and advanced drugs.

In addition to this, the massive investments being made are also significant contributors to the anticipated revenue generation. Companies in Europe are also expected to partake in the revenue generation. Also, the Asia Pacific region is expected to experience an increase in revenue generation through structural investments.

Prices of manufactured excipients across various regions globally are dependent on the excipient supply and excipient demand chain within each region. Also, this is dependent on the quality of excipients being produced in each of these regions.

What key factors drive the global pharmaceutical excipients market?

The pharmaceutical drug market size is growing rapidly, and its growth is expected to drive positively impact the growth and size of the pharmaceutical excipient market. In addition to this, several other key factors have driven and are still driving the pharmaceutical excipient market’s growth. Some of these factors include advancement in functional excipient development, increased use and expansion of biopharmaceuticals, large patient population base, the prevalence of chronic diseases, the rapid growth of the biosimilar industry, increasing demand for generic drug, patent expiries, and development of multi-functional and co processed excipient. These key factors have primarily contributed to the growth of the pharmaceutical excipient market during the forecast period.

Excipients play a variety of roles in drug formulations and make up the bulk of almost every drug. The pharmaceutical industry is rapidly advancing through biotechnology to provide safer and more effective drugs for therapeutic purposes. Novel excipients are gaining worldwide attention, and the push for a novel excipient review and evaluation system is growing stronger. In a few years from now, there may be the creation of an established novel excipients evaluation process or system. The establishment of these evaluation processes would allow companies to grow, deliver on-demand health needs to patients, and spur the global pharmaceutical excipients market’s growth.

References

https://www.pharmaexcipients.com/pharmaceutical-excipients-some-definition/

https://www.biopharma-excellence.com/news/2019/12/13/best-practices-in-dealing-with-novel-excipients

https://www.pharmaexcipients.com/wp-content/uploads/attachments/CO5_2013_RGB_80-83.pdf?t=1446883266

https://www.slideshare.net/mobile/SalmanBaig6/novel-excipients

https://www.pharmaexcipients.com/news

References

Upcoming Events

-

Pharmapack Europe 2025

Paris Expo, Porte de Versailles - Hall 7.2 | Paris, France

22 Jan 2025 - 23 Jan 2025 -

CPHI Japan 2025

East Halls 4, 5 & 6, Tokyo Big Sight, Tokyo, Japan

09 Apr 2025 – 11 Apr 2025 -

CPHI Americas 2025

Pennsylvania Convention Center, Philadelphia

20 May 2025 - 22 May 2025

Pharmaceutical Industry Webinars

-

Webinar Leveraging Real-Time Clinical Data to Deliver Certainty in Solubility Enhancement and Modified Release Development

-

12th December 2024

-

3pm BST/ 4pm CET

-

-

Webinar The CPHI Sustainability Collective: A New Initiative to Support a Sustainable Pharma Value Chain

-

10th December 2024

-

3pm BST /4pm CET

-

-

Webinar Key to Success: A CDMO's Pathway to Biologics Excellence

-

5th November 2024

-

3pm BST/ 4pm CET

-

-

Webinar The Changing Dynamics of Global API Manufacturing

-

17th September 2024

-

3pm BST/ 4pm CET

-

-

Webinar Shaping the Future of Italy’s Pharma Market: Trends and Opportunities

-

4th September 2024

-

4pm CET/ 10am EST

-

-

Webinar Fragment-Based Oligonucleotide and Oligopeptide Synthesis

-

30th Jul 2023

-

4pm CET / 10am EST

-

-

Webinar GMP Rationale for Sterile High-Potency/Toxic Pharmaceuticals

-

18th June 2024

-

4pm CET / 10am EST

-

-

Webinar Unlocking Opportunities in the Growing Pharma Landscape of The Middle East

-

5th June 2024

-

3pm CET / 9am EST

-

-

Webinar Exploring Technological Trends in the Future of Pharmaceutical Manufacturing

-

23rd May 2024

-

4pm CET / 10am EST

-

-

Webinar Achieving Manufacturing Excellence Through Digital Transformation

-

16th April 2024

-

4pm CET / 10am EST

-

-

Webinar Made in Africa: What’s Driving Pharma Manufacturing

-

28th March 2024

-

4pm CET / 10am EST

-

-

Webinar Case Study: Risk Management for Annex 1 Sterile Production EMS

-

28th February 2024

-

4pm CET / 10am EST

-

-

Webinar Innovative Strategies for B2B Pharma Marketeers: Driving Value through Content

-

20th February 2024

-

4pm CET / 10am EST

-

-

Webinar Revolutionizing Pharma: Data and AI Unleashed

-

18th January 2024

-

4pm CET / 10am EST

-

-

Webinar Optimal Temperature: Elevating Biologics Cold Chain Excellence

-

16th January 2024

-

4pm CET / 10am EST

-

-

Webinar Market Outlook – The Biggest Pharma Trends of 2024

-

12th December 2023

-

4pm CET / 10am EST

-

-

Webinar The Next Frontier – Emerging Opportunities in the LATAM Pharma Market

-

21st November 2023

-

4pm CET / 10am EST

-

-

Webinar Vistamaxx™ MED - imagine the possibilities for healthcare product performance

-

10th October, 2023

-

4pm CET / 10am EST

-

Position your company at the heart of the global Pharma industry with a CPHI Online membership

-

Your products and solutions visible to thousands of visitors within the largest Pharma marketplace

-

Generate high-quality, engaged leads for your business, all year round

-